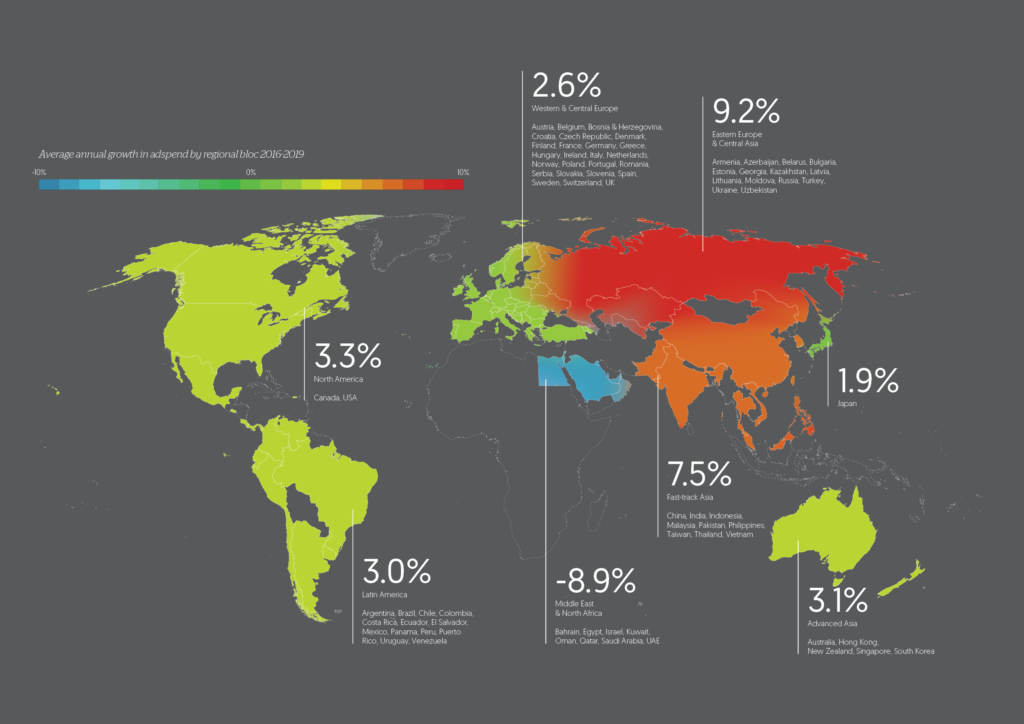

In our June 2017 Advertising Expenditure Forecasts, we predicted global adspend would grow at an average rate of 4.1% a year between 2016 and 2019. But growth rates vary hugely by market, from double-digit gains to double-digit declines. There are also big differences in the ‘macro-regions’ that are often treated as single economic units, such as Western Europe, or Asia Pacific. The ad market in the Philippines, for example, is growing at 20% a year, while Japan’s is growing at 2%. To get a more consistent picture of regional growth, we look at smaller regions, defined by the similarity of the performance of their ad markets as well as their geographical proximity.

North America

North America was the first region to suffer the effects of the financial crisis, but it was also quick to recover, and adspend in North America was more robust than in Western & Central Europe between 2012 and 2014. This changed in 2015 as the European markets most affected by the eurozone crisis recovered rapidly, while declining network television ratings eroded US adspend growth. North America should start outperforming Western & Central Europe again in 2017 as political and economic uncertainty in the UK drags down growth in the latter. We estimate that North American adspend grew 4.3% in 2016, and forecast an average of 3.3% growth a year to 2019.

Latin America

Argentina, Brazil, Ecuador and Venezuela (which account for 59% of Latin American advertising expenditure) were in recession in 2016, compounded by rapid devaluation in Argentina and full-blown crisis in Venezuela, which is running out of basic supplies and is heading for hyperinflation. Adspend shrank by 0.2% in 2016, after growing 7.5% in 2015. Argentina’s recession looks like it came to an end in late 2016, while Brazil emerged from its longest recession since the 1930s in 2017. Meanwhile, Venezuela’s sustained collapse in adspend means that its continued decline weighs less on the regional total each year. We forecast 3.0% average annual growth in Latin American adspend to 2019.

Western & Central Europe

Western & Central Europe was one of the regions most affected by the financial crisis of 2008-2009, which then turned into the eurozone crisis. The eurozone crisis is not definitively over, but the region’s ad market has been enjoying solid recovery since 2014, after which adspend has grown at about 4% a year.

The UK was the stand-out growth market in Western & Central Europe from 2011 to 2016, growing at an average of 7.3% a year. However, a slowing economy, gathering inflation, and political uncertainty over the mid-year elections and upcoming Brexit negotiations have all contributed to a sharp drop in adspend growth in the UK in 2017. We now forecast just 0.9% growth in UK adspend this year, compared to 9.6% growth in 2016. This drop in UK growth, together with the quadrennial comparison, will drag growth in Western & Central European adspend down from 4.5% in 2016 to 2.2% in 2017, and an annual average of 2.6% to 2019.

MENA

The drop in oil prices in 2014 has had a severe effect on the economies in MENA, and has prompted advertisers to cut back their budgets in anticipation of lower consumer demand. Political turmoil and conflict have worsened, further shaking advertisers’ confidence in the region. We forecast an 18.6% drop in adspend in MENA this year, following 10.0% decline 2016. The region’s decline should moderate over time, but we predict no recovery during our forecast period. We expect adspend to shrink 6.3% in 2018 and 0.7% in 2019.

Eastern Europe & Central Asia

Ad markets in Eastern European & Central Asia generally recovered quickly after the 2009 downturn and then continued their healthy pace of growth for the next few years. In 2014, though, the conflict in Ukraine severely disrupted the domestic ad market, while Russia suffered from sanctions imposed by the US and the EU, the sanctions it imposed in response, and a withdrawal of international investment. These shocks were exacerbated by a sharp drop in the price of oil – which accounted for 70% of Russia’s exports in 2014 – and devaluation of the Ukrainian and Russian currencies.

Adspend shrunk 0.7% in Eastern Europe & Central Asia in 2014, and by 8.2% in 2015. The worst-affected ad markets began to recover in 2016, however, and this recovery has continued in 2017. Adspend grew 4.3% in 2016, and we forecast an average of 9.2% annual growth to 2019, making Eastern Europe & Central Asia the fastest-growing regional bloc over this period.

Fast-track Asia

Fast-track Asia is characterised by economies that are growing extremely rapidly as they adopt Western technology and practices and innovate new ones, while benefiting from the rapid inflow of funds from investors hoping to tap into this growth. Fast-track Asia barely noticed the 2009 downturn (ad expenditure grew by 7.8% that year) and since then has grown very strongly, ending 2016 up an estimated 9.2%. However, the Chinese economy – the main engine of growth in Fast-track Asia – is slowing down after years of blistering growth, and the ad market is slowing alongside it. China accounts for 73% of adspend in Fast-track Asia, so its slowdown naturally has a large effect on the region as a whole. We expect ad expenditure in Fast-track Asia to grow 7.9% in 2017, and at an average rate of 7.5% a year between 2016 and 2019, down from 10.8% a year between 2011 and 2016.

Japan

Japan behaves differently enough from other markets in Asia to be treated separately. Despite recent measures of economic stimulus, Japan remains stuck in its rut of persistent low growth. We forecast average adspend growth of 1.9% a year between 2016 and 2019, after a relatively strong year of 3.0% growth in 2016.

Advanced Asia

Apart from Japan, there are five countries in Asia with developed economies and advanced ad markets that we have placed in a group called Advanced Asia: Australia, New Zealand, Hong Kong, Singapore and South Korea. Adspend grew here at 5.3% in 2015, the best performance since 2011, but slipped back to 1.4% in 2016. Australia and Singapore faced tough comparatives – Australia after an extremely strong year in 2015, and Singapore after its 50th birthday celebrations – while Hong Kong has suffered from a drop in shoppers visiting from mainland China. We now expect Advanced Asia to maintain a growth rate averaging 3.1% a year through to 2019.

For more on current trends in global advertising, see our new issue of Global Intelligence magazine, while our full forecasts for advertising expenditure by market and by medium are available for purchase here.

SIGN UP FOR ZENITH INSIGHTS