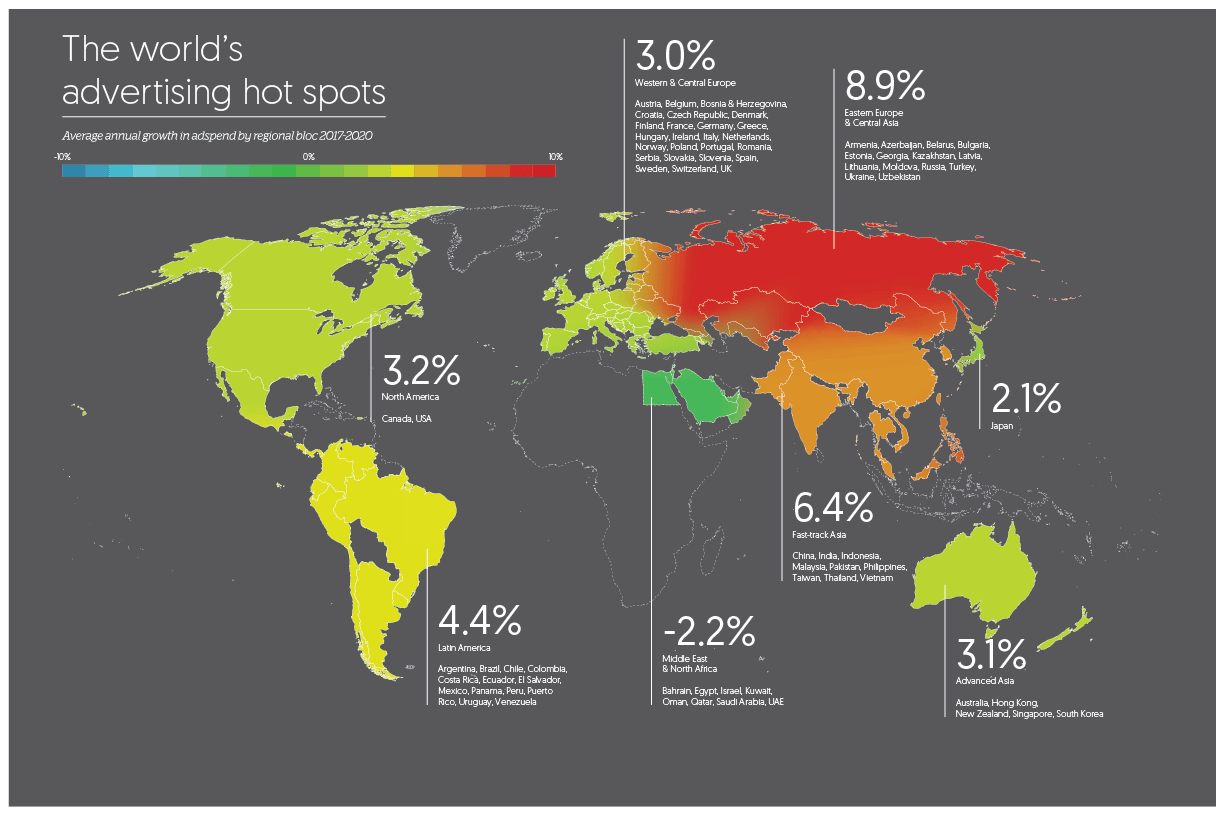

In this extract from the fourth edition of our Global Intelligence magazine we look at the regions where adspend is growing fastest – and where it’s struggling

We regularly examine the growth rates of different regional blocs defined by the similarity of the performance of their ad markets as well as their geographical proximity. This captures the behaviour of different regional ad markets more effectively than looking at regions defined purely by geography, such as Western Europe, Central & Eastern Europe and Asia Pacific.

Here’s what the growth rate of adspend for the next few years looks like for each of these regions, according to our local experts.

North America

North America started outperforming Western & Central Europe in 2016 as political and economic uncertainty in the UK dragged down growth in the latter, and Canada’s healthy economy boosted its ad market. We expect North American adspend to grow 3.4% in 2018, and forecast an average of 3.2% growth a year to 2020.

Latin America

Argentina and Brazil are now out of recession, and Venezuela’s sustained collapse in adspend means that its continued decline weighs less on the regional total each year. We forecast 2.8% growth in Latin America adspend this year, 3.4% next year, and 4.4% average annual growth to 2020.

Western & Central Europe

A slowing economy, gathering inflation, and political uncertainty over the mid-year elections and Brexit negotiations have all contr ibuted to a sharp slowdown in UK adspend this year. And although the eurozone economy has strengthened this year, this has not yet fed through to advertising. We estimate that adspend will have risen just 1.3% in the eurozone by the end of 2017, before accelerating to 2.5% growth in 2018. We now forecast 1.7% growth in Western & Central European adspend this year, down from 3.9% growth in 2016.

MENA

The drop in oil prices in 2014 has had a severe effect on the economies in MENA, and has prompted advertisers to cut back their budgets in anticipation of lower consumer demand. Political turmoil and conflict have worsened, further shaking advertisers’ confidence in the region. We forecast an 18.6% drop in adspend in MENA this year, following 10.0% decline in 2016. The region’s decline should moderate in 2018 and 2019, and we forecast very modest 0.4% growth in 2020.

Eastern Europe & Central Asia

In 2014 the conflict in Ukraine severely disrupted the domestic ad market, while Russia suffered from sanctions imposed by the US and the EU, the sanctions it imposed in response, and a withdrawal of international investment. These shocks were exacerbated by a sharp drop in the price of oil – which accounted for 70% of Russia’s exports in 2014 – and devaluation of the Ukrainian and Russian currencies. The worst-affected ad markets began to recover in 2016, however, and this recovery has continued in 2017, consistently outperforming expectations. We now think adspend will be up 11.1% in 2017, after which growth will settle down to a more normal 8.9% a year to 2020, ensuring that Eastern Europe & Central Asia remains the fastest-growing regional bloc over this period.

Fast-track Asia

The Chinese economy – the main engine of growth in Fast-track Asia – is slowing down after years of blistering growth, and the ad market is slowing alongside it. The extended period of mourning for King Bhumibol Adulyadej has led to a second year of decline for Thailand, and Malaysia’s recovery from the downturn of 2016 has been less rapid than we hoped. We expect ad expenditure in Fast-track Asia to grow 7.6% in 2017, and at an average rate of 6.4% a year between 2017 and 2020. This is less rapid than the growth in Eastern Europe and Central Asia, but Fast-track Asia is ten times larger, so contributes a lot more to global adspend growth.

Japan

Japan behaves differently enough from other markets in Asia to be treated separately. Despite recent measures of economic stimulus, Japan remains stuck in its rut of persistent low growth. We forecast average adspend growth of 2.1% a year between 2017 and 2020, slightly behind the average annual growth rate of 2.4% between 2012 and 2017.

Advanced Asia

Apart from Japan, there are five countries in Asia with developed economies and advanced ad markets that we have placed in a group called Advanced Asia: Australia, New Zealand, Hong Kong, Singapore and South Korea. Adspend grew here at 5.3% in 2015, the best performance since 2011, but has slipped back to an estimated 1.6% this year. We expect this to be the trough, and forecast 3.1% average annual growth to 2017, fractionally above the 2.9% average growth rate since 2012.

Please click here to download a copy of Global Intelligence magazine.

SIGN UP FOR ZENITH INSIGHTS