Digital challenger brands are helping to spur adspend growth by using venture capital to fund broad awareness campaigns across both digital and traditional media.

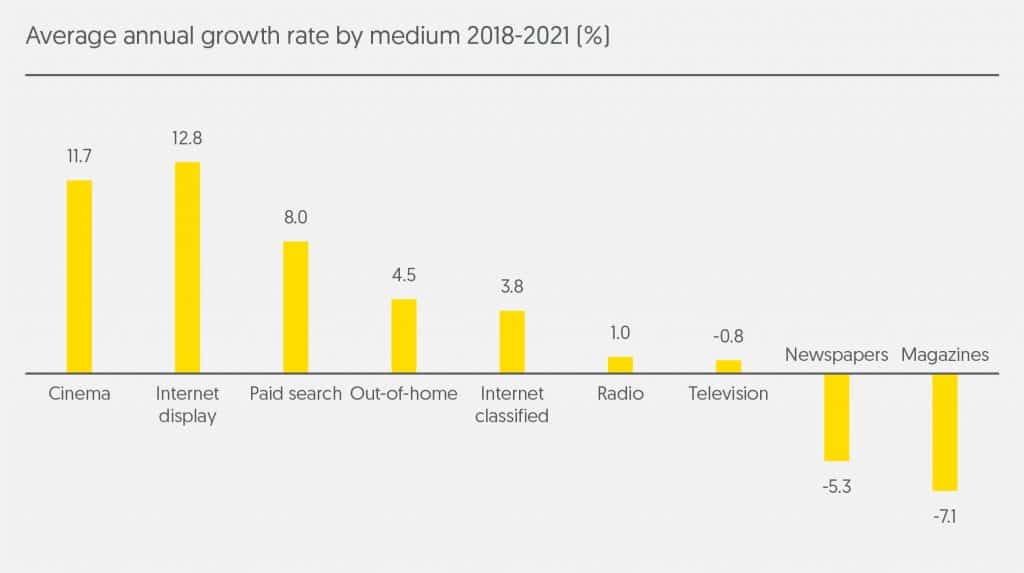

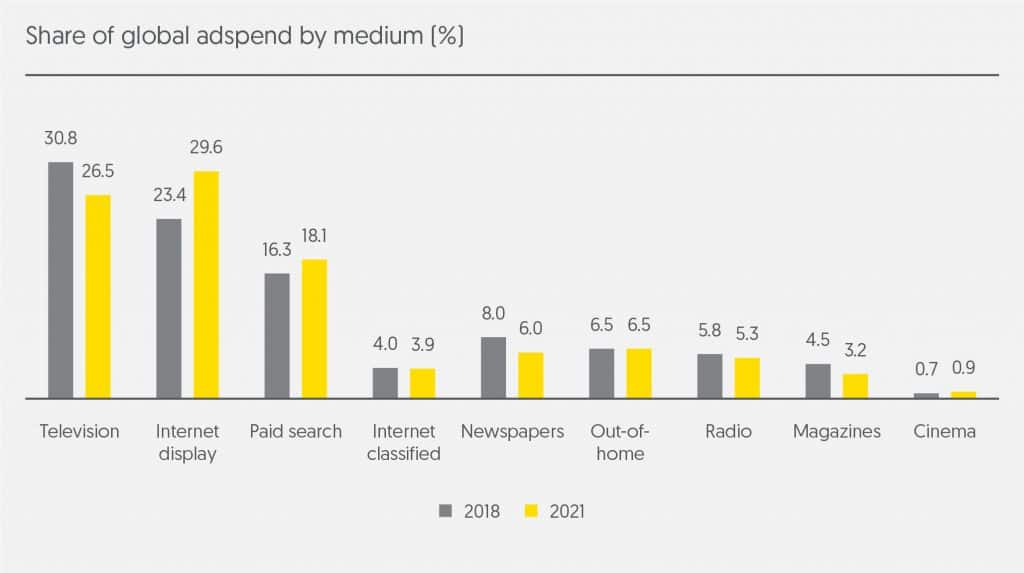

Internet adspend is leading ad market growth, and the fastest growth is coming from the overlapping channels of online video and social media, which we expect to grow by 18% and 17% a year to 2021 respectively. We forecast display advertising as a whole – which encompasses video and social, as well as banners – to grow by 13% a year, while paid search and classified lag behind, growing at an average of 8% and 4% a year respectively.

It’s not just small businesses that are driving this growth. Digital-based challengers to established brands are using technology to shake up every category, using venture capital – new money to the ad market – to fund digital- focused awareness campaigns. These brands are, or are aiming to be, large enough that they need scaled exposure to win new customers and build market share. Doing this online requires a quite different strategy to building awareness through traditional media. Social video combines wide reach, precise targeting and high-impact creative, but attention spans are notoriously short, with the average swipe through a news feed taking just a couple of seconds. Brands need to create awareness through repeated short exposures, and use personalisation to make ads more relevant to viewers to grab and hold their attention.

Challenger brands do not rely on digital advertising alone, and are establishing themselves as prominent advertisers in offline media, particularly out-of-home. Out-of-home advertising is the fastest-growing ‘traditional’ medium in dollar terms – we expect it to grow by US$5.4bn between 2018 and 2021. Out-of-home is still benefiting from the spread of digital screens, but also from the emergence of programmatic trading, allowing agencies to make more efficient and effective data-enabled transactions.

Spending by these digital-native brands is helping to prop up global television adspend, which is suffering from rapid declines in traditional television viewing in key markets like the US and China. We forecast television advertising to shrink by 0.7% a year to 2021. Note that this includes only traditional, linear television; television-like services delivered over the internet are included in our internet adspend totals.

Print advertising continues its decade-long decline. We forecast magazine adspend to shrink by US$5.4bn between 2018 and 2021, and newspaper adspend to shrink by US$7.2bn, with no end to either decline in sight. Between 2013 and 2018 their combined share of global adspend halved from 24% to 12%, and we expect this share to fall further to 9% by 2021. Again, these figures only include advertising in printed publications – any advertising on publishers’ websites or other online brand extensions is included in the internet advertising total.

SIGN UP FOR ZENITH INSIGHTS