In this second excerpt from Global Intelligence issue 2, we look at how the UK’s ad market has held up after last year’s vote to leave the EU

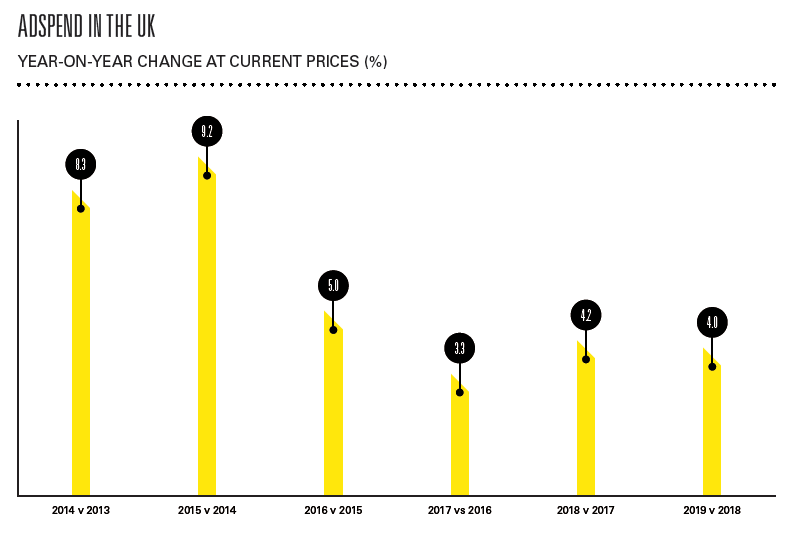

Though few advertisers have explicitly reduced their budgets as a result of the Brexit vote, the ad market softened slightly over the course of 2016. The headline economic figures have been strong, but it is clear that the UK is in for some tough negotiations over trade and finance, which is going to make companies wary of undertaking new projects. But in 2014 and 2015 the UK ad market experienced its best two years of growth since the 1990s, so the comparison was always going to be tough. We now estimate UK adspend growth at 5.0% in 2016, down from the 5.6% we forecast before the referendum, and we forecast 3.3% growth for 2017, down from 4.0%.

In the second half of 2015 TV revenues grew 10%, driven by the Rugby World Cup and strong economic conditions. One year later, and the TV market was only down 1% in in the same period. Despite some volatility after the EU referendum, spot revenue has increased across a number of categories, with motors up 2%, pharmaceuticals up 9% and newspapers up 18%. These increases have been counterbalanced by decline from finance (down 12%), retail (5%) and FMCG (down 1%). Over the whole of 2016 we currently estimate the TV market to have grown by 1%, and we expect flat spending in 2017.

We now have final radio revenues for the first half of 2016, when adspend grew 3% year on year. Radio adspend grew 6% in the first quarter, but fell back 0.9% in the second quarter. We don’t yet have official figures for the third quarter, but expect 2% growth, which we also forecast for the fourth quarter.

National newspaper revenues from print advertising declined 8.9% year on year in the second quarter of 2016. Only the entertainment & leisure and leisure-equipment categories increased their expenditure in the third quarter. It is a shame that the European football cup and the Olympics did not boost newspaper revenues by more, though the football appears to have done some good. Consumer magazines’ print advertising revenues declined 5.8% year on year in Q2 2016, while their display-only revenues (excluding classified) fell only 2.5%. This figure was positive in Q1, an encouraging sign for the future.

To download the full second issue of Global Intelligence please click here.

SIGN UP FOR ZENITH INSIGHTS