The demand for mass audiences continues to rise, but the supply is falling as consumers turn to non-commercial media. Media inflation has therefore exceeded adspend growth throughout the decade.

We forecast that advertisers will increase their global ad expenditure by 4.3% in 2020, but the commercial audiences supplied by media owners will shrink by 1.6%, fuelling a 6.1% increase in media prices. This will extend a trend that has continued since 2010.

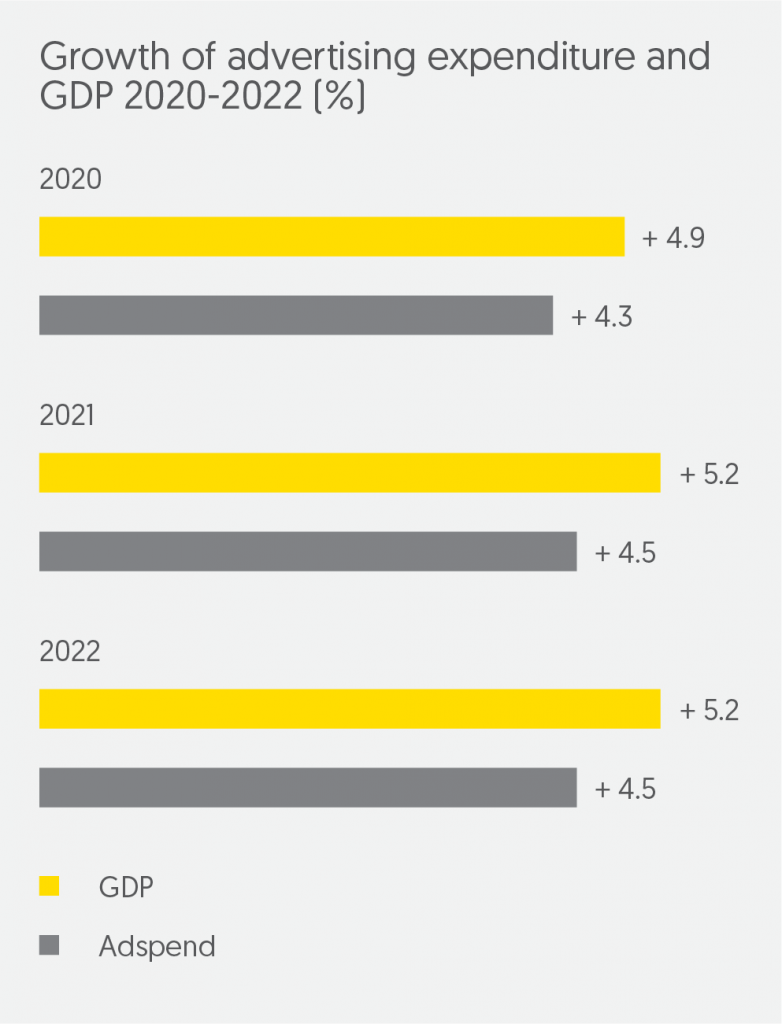

Demand for advertising has grown consistently throughout this decade. To sustain market share, large brands need to maintain brand awareness among buyers and potential buyers, which requires regular, brand-building campaigns with mass reach. The same goes for smaller brands looking to grow their business. Meanwhile small businesses, which may not have advertised at all previously, have embraced targeted advertising on digital platforms and injected new demand into the market. Advertising expenditure has grown by 5.1% on average since 2010.

However, traditional mass audiences are shrinking: first print, and now television in key markets. Many lost audiences are replacing television viewing with non-commercial video like Netflix, Amazon Prime Video, HBO, and eventually Disney+, reducing available audiences and creating fragmentation. The use of adblockers means that some audiences have low exposure to digital advertising. This rising demand and falling supply is increasing prices rapidly. The supply of commercial audiences has shrunk by 1.3% a year on average since 2010, according to exclusive Zenith research, while media inflation has averaged 6.5% a year.

The days when we could find audiences all in one place are long gone. So brands need to use to use technology to find them wherever they are, online or offline, and win back value through efficiency and effectiveness – by targeting consumers with the right message at the right point in the consumer journey.

US-China trade war to counter the quadrennial effect in 2020

Next year is a ‘quadrennial’ year, benefitting from the Summer Olympics, UEFA Euro 2020 and US Presidential elections, which occur every four years. These ad expenditure stimulants are expected to add US$7.5bn into the global ad market. In normal circumstances, adspend growth in 2020 would be comfortably above this year’s growth rate. However, forecasted 4.3% growth next year is barely above 2019’s estimated 4.2% growth. The US-China trade dispute is disrupting economies across the world, interrupting supply chains and rerouting trade and investment. This is reducing growth and raising uncertainty, making advertisers more cautious about budgeting. Zenith estimates this economic headwind will cost the global ad market 1.1 percentage points of growth in 2020. Without it, the market would be up by 5.4%.

SIGN UP FOR ZENITH INSIGHTS