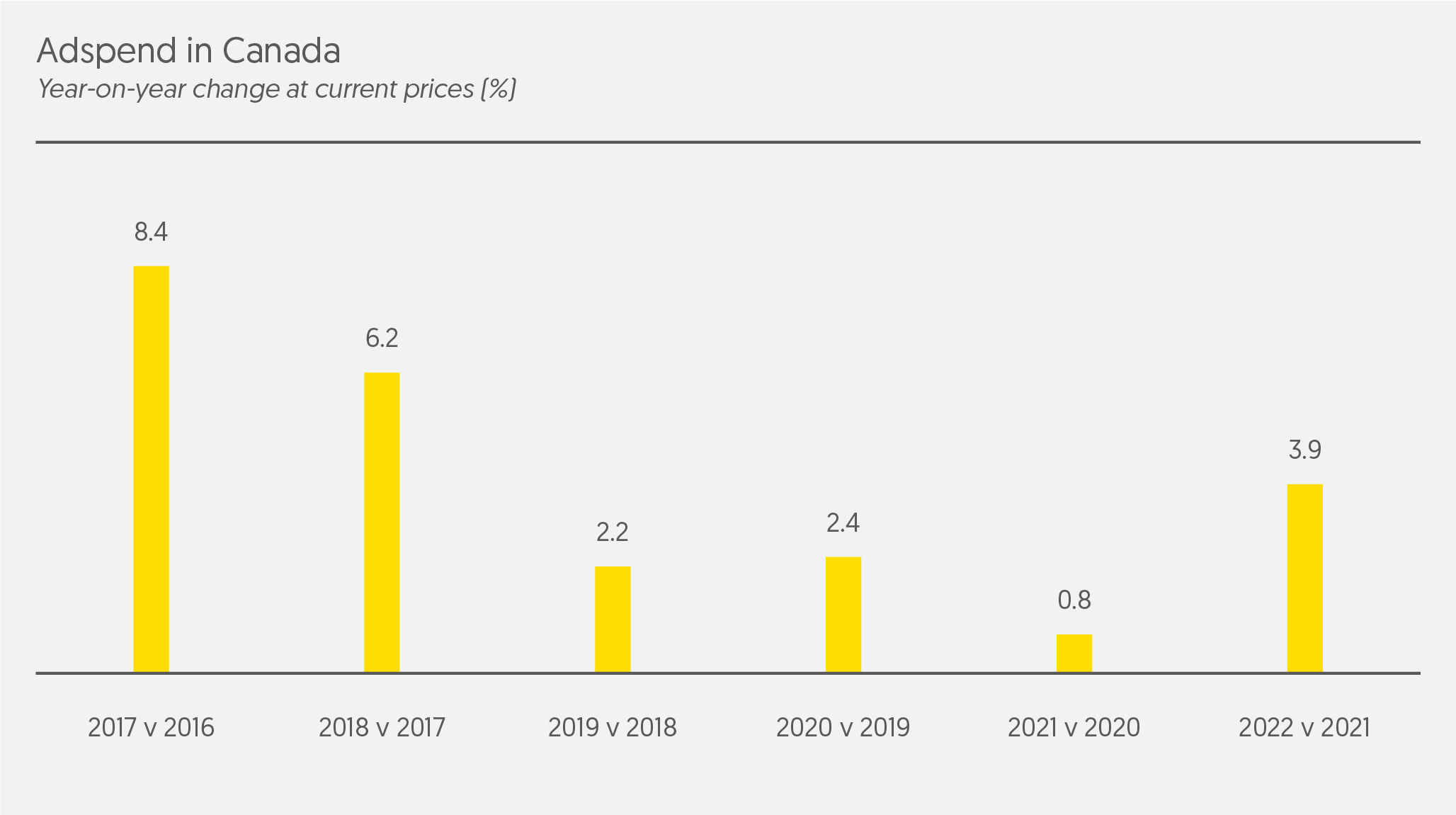

CANNABIS IS AN EMERGING CATEGORY IN CANADA THAT’S BOLSTERING ADSPEND GROWTH IN A SLOWING ECONOMY

Cannabis has been legal to purchase in Canada since October 2018, resulting in Health Canada enforcing the Cannabis Act; this addresses restrictions on the promotion and advertisements of cannabis and cannabis related products. The effect on ad dollars in the market is yet to be determined as marketers, vendors, and broadcasters are still trying to create new processes while remaining within the rules laid out by the various entities. CPG and health & beauty are emerging as partners for the cannabis category, along with more traditional bricks-and-mortar cannabis retail locations. The market is still in the early stages of seeing legal advertising of this product for the first time. OOH seems to be emerging as the dominant media channel in Canada, which aligns with some early US adspend figures for cannabis.

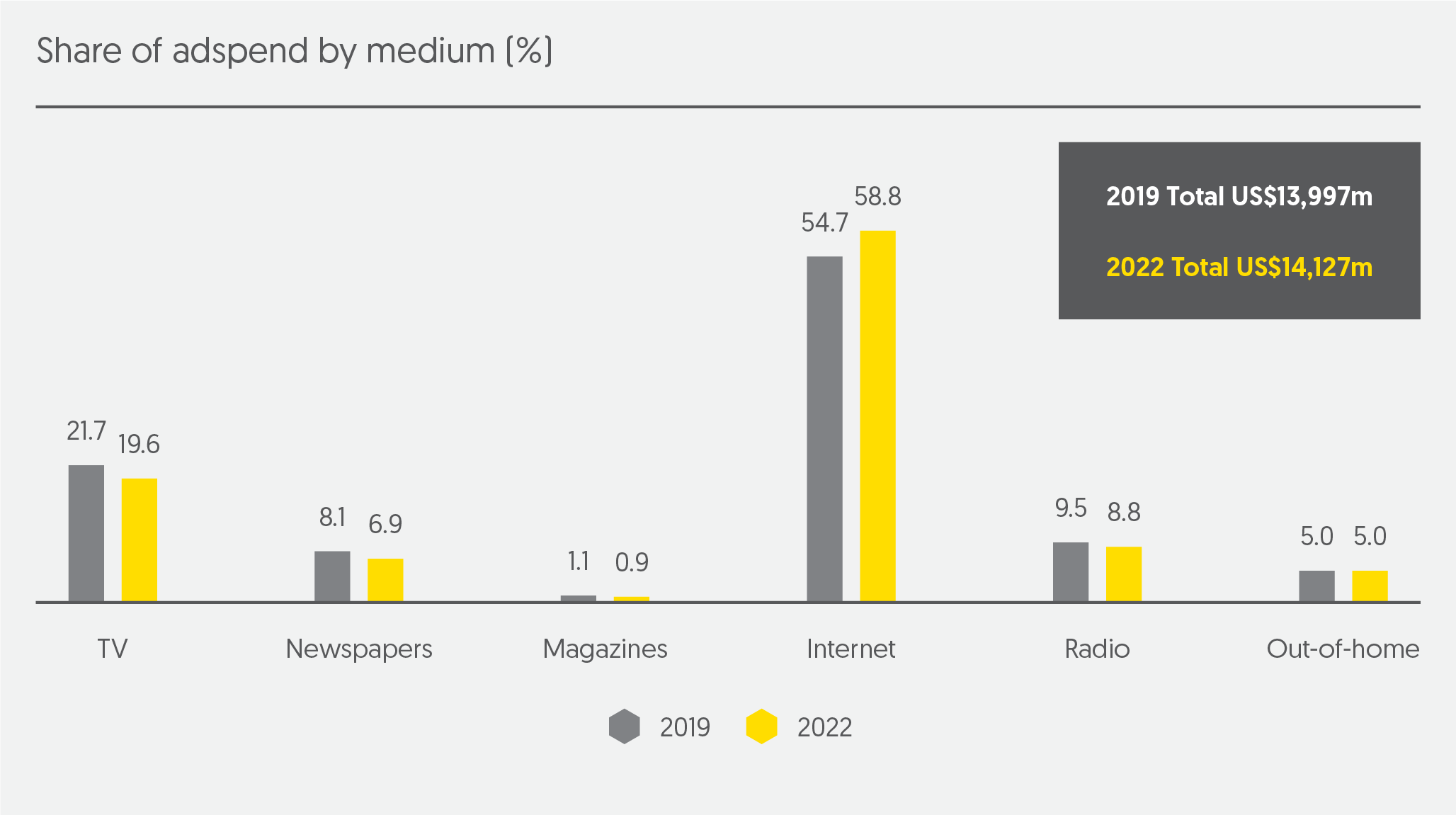

Newspaper spend is trending well in 2019, showing an increase versus 2018, but is forecast to decline over the next few years. Some Canadian expenditure sources are attributing the growth to the still strong demand from an aging population, as well as the medium’s strength within financial and automotive categories. Magazines on the other hand continue to decline, with publishers reducing pages or closing entirely. More and more spend is going to digital magazines.

The traditional mass reach channels of TV and radio are relatively stable, but have slight declines forecast to 2021. Demand is still strong for these channels, but audiences are slowly eroding, driving up the costs per point. Growth is forecast to return in 2022 as broadcasters get better at integrating digital style offerings into their buying platforms within both video and audio. Holistic measurement is also advancing as major measurement companies try to align their online video and linear TV data, as well as traditional radio and audio streaming impressions.

OOH is forecast to increase due to the promise of increased digital inventory for OOH advertisers. Measurement strategies, targeting, and buying capabilities are still in early phases but should strengthen with time allowing for greater efficiencies.

Internet spend is growing steadily with mobile crossing the 50% share of spend mark in 2019. Video demand is high but faces difficulty from an inventory standpoint. Online video is also the only channel where spend does not match consumption metrics due to the fact that so much of reported online video viewing cannot be monetised through advertising, with the likes of Netflix, Amazon Prime and Crave TV selling no ad slots.