The paid search market is slowing as it approaches US$100bn in size, a milestone it will reach next year. But the integration of search with shopping – as Amazon steps up its search services, and Google improves its e-commerce offering – will continue to make search more valuable.

Zenith has increased its forecast for growth in paid-search adspend this year from 9% to 10%, but growth is decelerating as the channel reaches full maturity. However, emerging paid search formats – like commerce, home assistants and other voice-activated assistants – will drive growth over next few years.

Up-and-coming search platforms to take share from market leaders

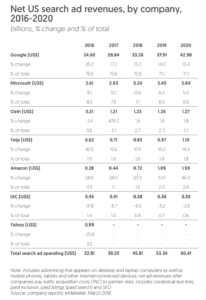

eMarketer has identified a loss of US market share by all the main search providers in 2017, and expects that to continue to 2020. It forecasts that Google’s share of US search ad revenue will fall from 75.0% in 2016 to 71.1% in 2020, while Microsoft’s share will drop from 8.0% in 2016 to 6.0% in 2020. Oath’s share jumped from 0.6% in 2016 to 3.1% in 2017, but that’s because it acquired Yahoo that year. Their combined share fell, and eMarketer predicts it will fall further over its forecast period.

The big winner will be Amazon, which eMarketer forecasts to increase its share of US search from 0.9% in 2016 to 2.6% in 2020, an increase of US$1.3bn. Amazon has really only dipped its toe into the paid search market; given its centrality to the e-commerce market, it could be a huge force in the market if it chose to.

The seven listed search providers accounted for 91% of spend in 2016. eMarketer expects them to account for 84% of spend by 2020 as the market opens up to up-and-coming competitors.