Within each e-retailer environment there are many ways to improve your media investments, whether directly or through self-serve marketing solutions.

With the launch of self-serve marketing solutions to manage your on-retailer inventory and promotion, such as Amazon Advertising, traditional retailers need to make it easier for brands to do the same with them. However, traditional commercial agreements do not offer transparent, robust data/reporting or innovative digital solutions for brands. Partnerships with brands represent a key opportunity for retailers to win back share of commercial investments and for brands to drive growth.

In order to get the most value, brands need to skill up and align their marketing and sales teams to clarify their data requirements to ensure that their marketing campaigns are considered within agreements and measurable through to sale on retailer platforms.

Amazon’s advertising solutions are forcing brands to reconsider how they budget for e-commerce and whether that investment should come from marketing or sales. Amazon offers multiple ways to promote your brand, including Sponsored Products and display through the Amazon DSP. Search is most often the way that customers are getting to product pages (86%), rather than browsing and navigating through its category pages (14%).

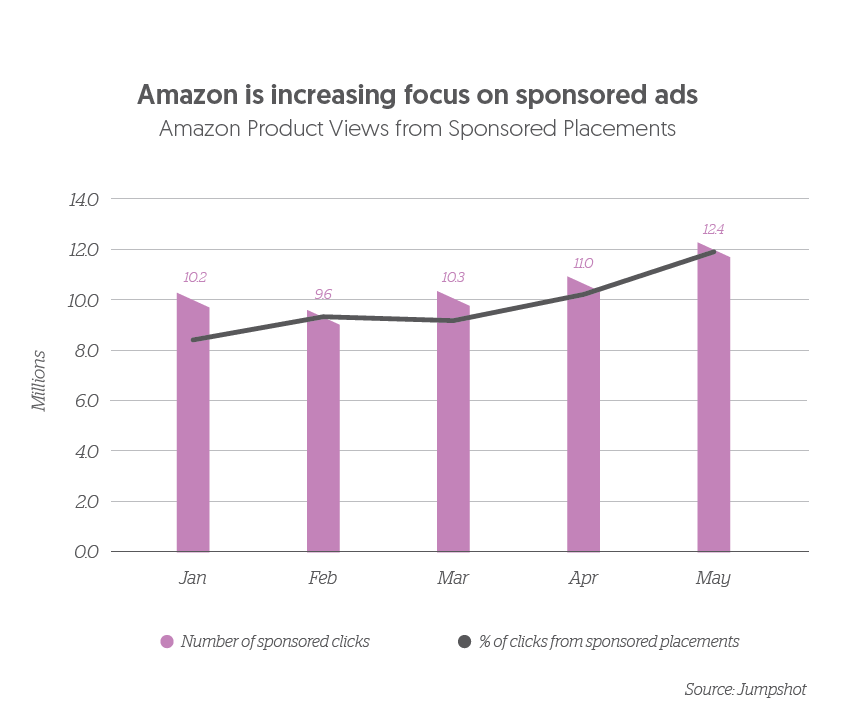

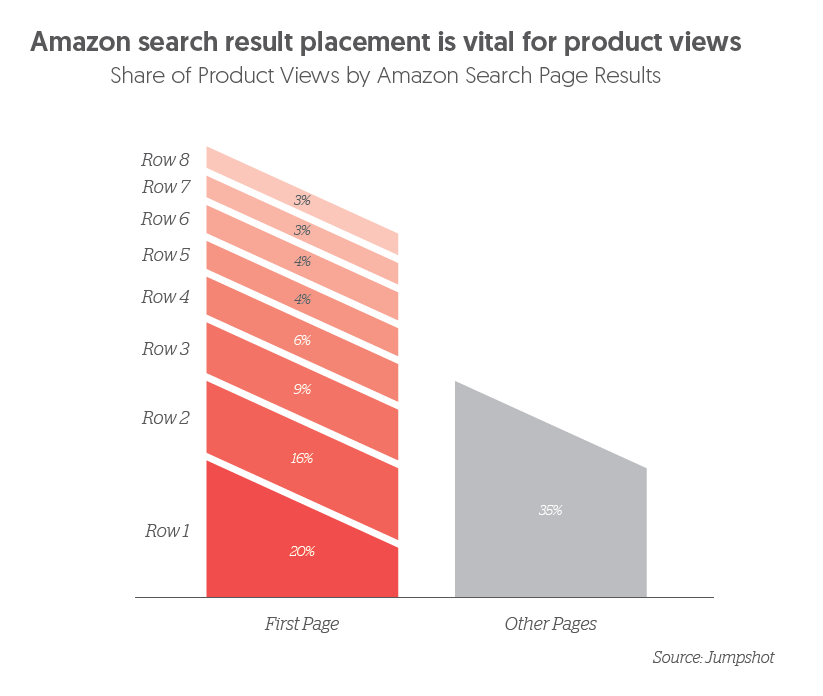

Analysis of Amazon search results shows that 20% of clicks come from the top row, with a small number of clicks coming from the second page. To date, sponsored listings remains at only 10% of total clicks from the search results. Clicks from Amazon’s sponsored product placements have increased 17% since the beginning of 2018 and this will only fuel competition for those lucrative top positions.

Within the makeup category, we identified that the share of product views from paid placements in the US was as high as 16% during the holiday season, vs a peak of 4% in the UK. Of the top five brands in the US, Maybelline New York drove almost 50% of the paid clicks, while its organic conversion rate was lower than Covergirl. This demonstrates a need for both brands to balance their organic optimisation and their investment in sponsored products. Mascara is one of the top driving keywords of conversions in make-up – identify how best to demonstrate your right to own that keyword and customer experience.

Brands will keep increasing their investment as the competition increases, which is why it’s important to measure incremental sales and set thresholds for profitable investment.

Whilst the solutions offered by Amazon are appealing and typically more transparent than the media offered within retailer commercial agreements, there are significant efficiencies to be had in those direct agreements. Here are a few examples where brands and retailers can partner together to drive growth.

Leveraging CRM propositions

Most retailers have robust customer databases that can be used to personalise messaging to customers. When retailers offer inclusion of a brand in an email, make sure that the audience that email is being sent to is a loyal customer of that brand, or has a propensity to buy that category.

Integrating with retailer media

Retailers spend a lot of money on media, especially during key shopping periods such as Christmas or Valentine’s Day. Instead of competing with them, leverage their increased visibility by ensuring your products are incorporated in their messaging, or that you have high visibility on their category pages. As an example, you can co-invest in shoppable solutions and jointly test their performance.

Elevating paid search through co-op investment

Retailers dominate paid search. Identify where you have the most profitable commercial agreement, and invest with a retailer to ensure your product has high visibility or where there is an opportunity to collectively drive category growth and share of your product within shopping results.

Traffic driving initiatives

Implement Buy Now or Where to Buy solutions on your brand website or from branded media activity. Direct your customers to your product pages where they are most likely to buy from, and consider this when negotiating your commercial agreement. For example, agree a % of your own traffic to direct to a retailer in return for data. The higher the traffic to your product, the more likely you will be included in their retargeting initiatives (ie. DPAs on Facebook)

What marketers should do next

• Make sure you have a clear understanding of your current ‘media’ investment with each retailer

• Develop testing scenarios for measuring incrementality

• Consider co-op search campaigns during key category moments

• Competition within Amazon will continue to increase, don’t become fully dependant on that growth