To build a joint growth plan with a retailer, you need to evaluate their e-commerce experience in line with customer preference.

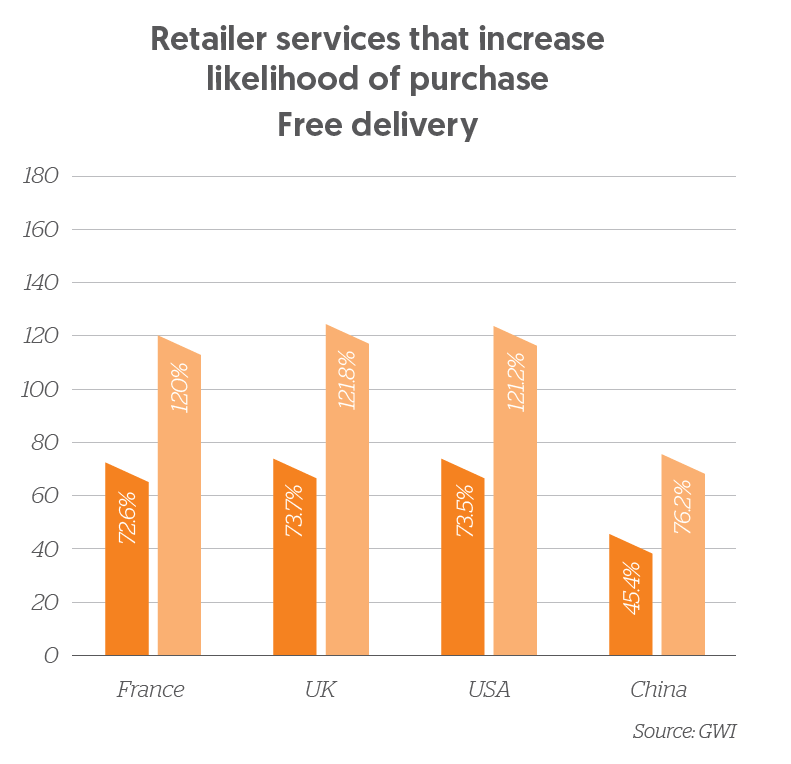

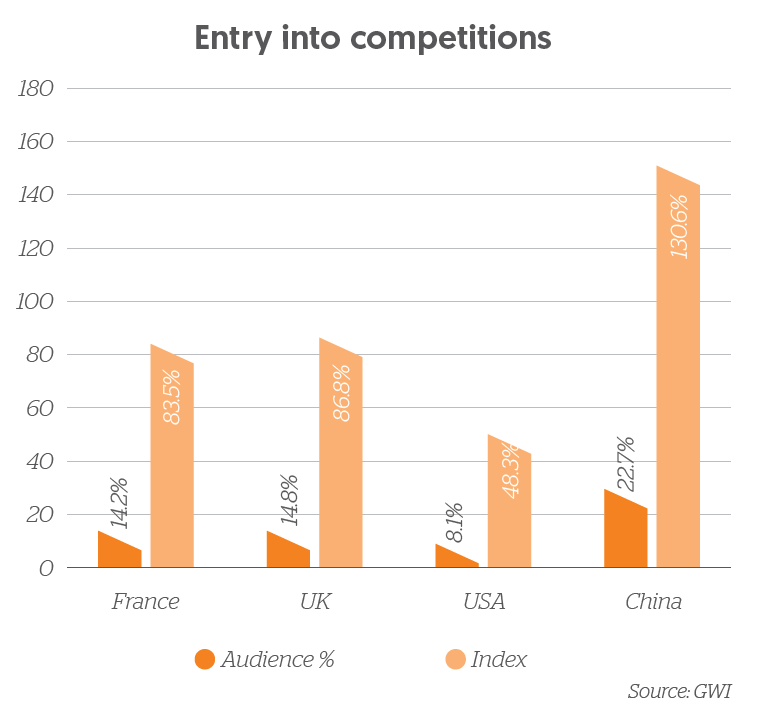

Customers now expect a connected shopping experience. They want consistent information regardless of where they decide to purchase a product, and value things like quick and easy checkout over the way a brand makes them feel. In the UK, for example, shoppers favour convenience. They are 36% more likely to value next-day delivery and 84% more likely to value click-and-collect options over the possibility of being entered into competitions. However in China consumers are 30% more likely to value competition entry over other shopping experiences (source GWI).

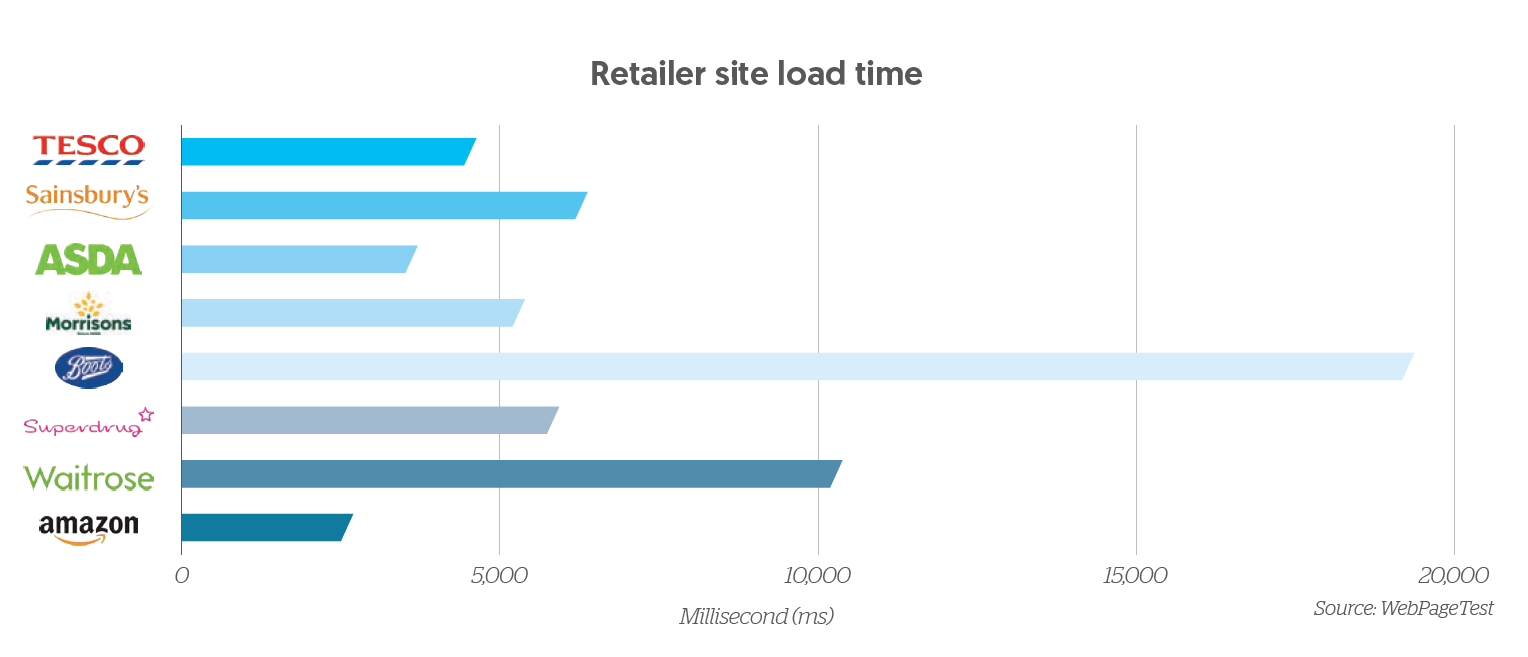

According to a study GWI carried out in July 2018, more than three quarters of internet users in the UK and US that month had added items to their online shopping cart, but hadn’t complete the purchase on that device. Consumers are more likely to abandon a checkout when shopping on mobile, highlighting the continued need for mobile optimisation, regardless of mobile’s direct reported impact on sales. Page speed is a big factor in customer abandonment, but so too is retailer’s ability to rank in Google.

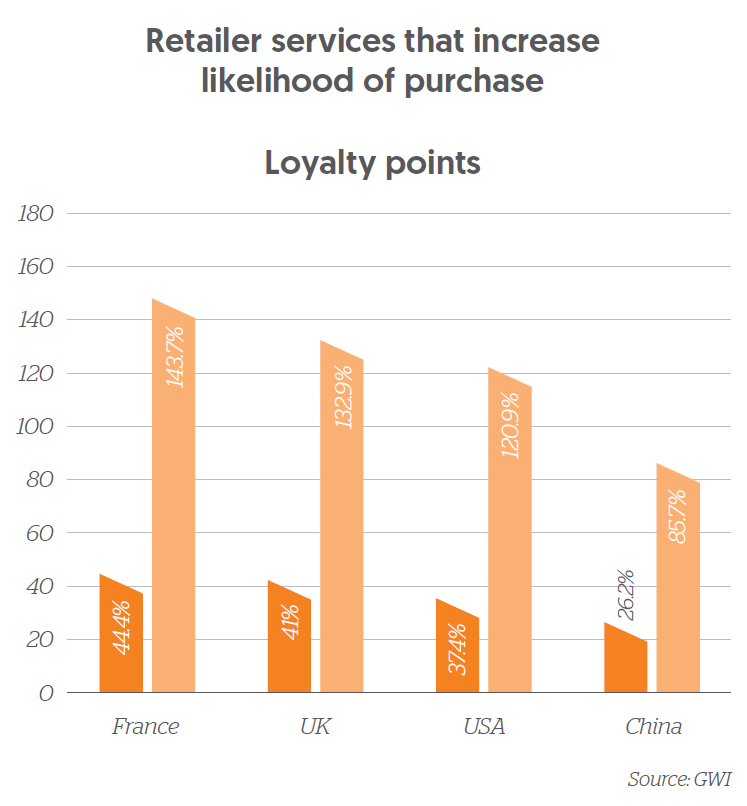

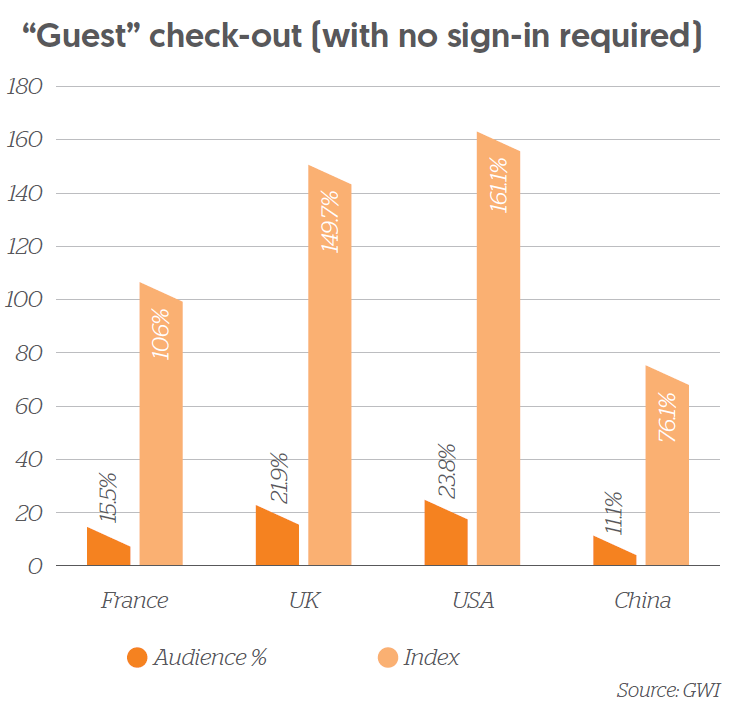

Another drive of abandonment in the check-out process is ease of payment. A quick and easy checkout process is one of the most effective ways to encourage someone to buy something online. In addition to checkout, having a clear returns policy, free delivery options and the option to collect loyalty points are also key drivers of purchase.

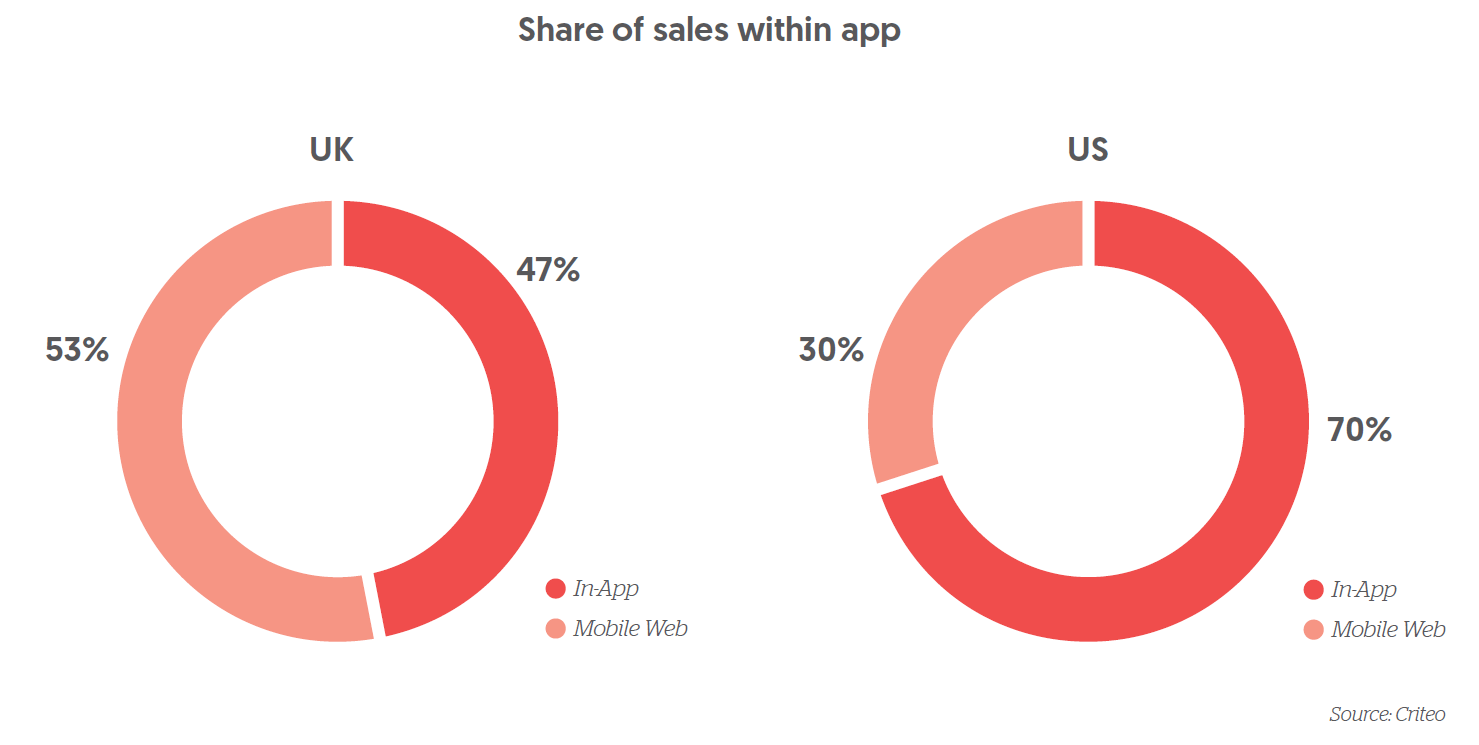

In the UK and US, shopping apps have a three times higher conversion rate than mobile web”

Device plays an important role when customers are deciding where to purchase. In Germany, for example, 44% of customers have researched a product on their mobile but only 27% have purchased. That is compared to 69% of customers that have purchased a product on a PC. This phenomenon is common across the US and Europe; however, China is predominantly mobile for research (73%) and purchase (71%).

Even within mobile, there are variances between web and app. In the US, apps account for over 70% of mobile sales, but only 43% in the UK. In the UK and US, shopping apps have a 3x higher conversion rate than mobile web, according to Criteo research. Globally, there has been a 22% increase in app transactions year on year.

Customers also want their experience to be personalised. Dunnhumby has seen a 7% category sales uplift measured in-store and online when using personalised advertising. At Tesco they have seen an increase in conversion rate when customers receive personalised messaging. Here are some key examples:

• Have You Forgotten?: 40% of customers go on to purchase and there is +1.5% weekly sales uplifts

• Relevant promotions: 30-50% e-mail open rate and there is +0.5% weekly sales uplifts

• Healthier Alternatives: 10% of customers chose alternatives; Greatest engagement from loyal Tesco customers, Pensioner and Older Adults segments

• Personalised Xmas lists: 92% conversion rate; 4.8% sales uplift; Helping to retain customers

What marketers should do next

Understanding the likelihood of your retail partners, or your direct to consumer solutions, to deliver a quality experience will help you prioritise your joint growth opportunities with retailers. This is how to do it:

• Identify within a market how customers are navigating between devices and the experience each retailer provides via mobile web or app

• Check a retailer’s page speed using tools like Google’s PageSpeed Insights

• Analyse the checkout process and delivery options each retailer provides

• Understand a retailers CRM programme and their personalisation solutions

SIGN UP FOR ZENITH INSIGHTS