With Amazon continuing to put commercial pressure on brands to ‘sell-through’, marketers need to find other areas of growth and develop profitable relationships with retailers.

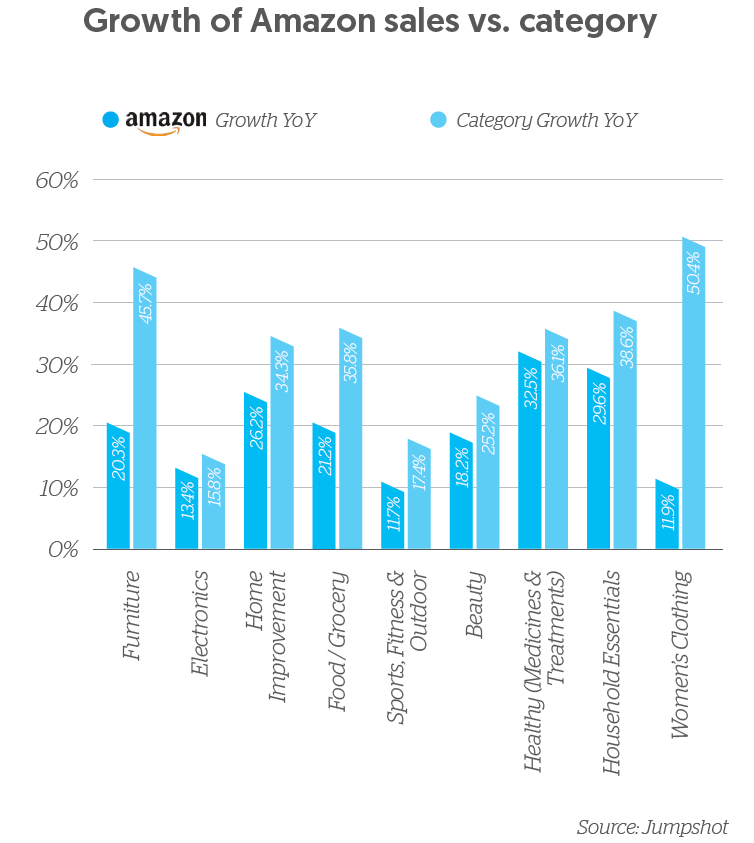

The commerce landscape remains fragmented with large national retailers trying to build strong e-retail platforms to compete against global players such as Amazon. From Zenith’s analysis of Jumpshot data, we have also seen the rise of e-commerce pure players such as Chewy.com which already represents 33% of Petcare conversions amongst the top retailers in the US. These pure play e-commerce companies have the potential to quickly build customer solutions and should be considered in the overall commerce mix due to their agility. In the US, Amazon’s growth is slower than total e-commerce growth by category, which means there is potentially more flexible growth with other partners. With all the challenges of the high street, retailers need to be open to more flexible partnerships to maintain their margin targets.

With all the challenges of the high street, retailers need to be open to flexible partnerships to maintain margin targets”

If a majority of your sales are coming through one retailer, creating the right partnerships with them is essential to drive category growth. Using your individual retailer assessment, you can better define where to invest. This should not be done in isolation: you need to compare each retailer for context and consider your profitability with each.

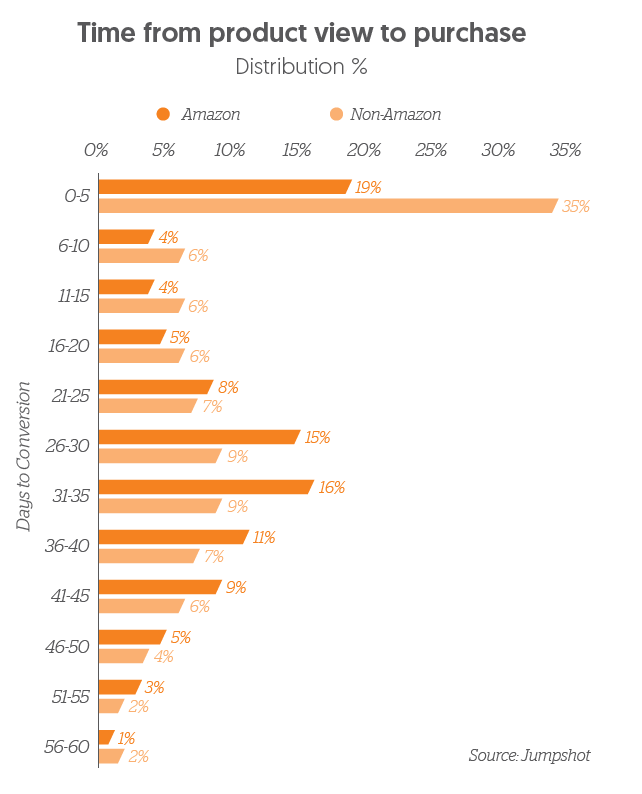

By analysing Jumpshot data, we know that more customers are starting their product search on Amazon. This means there is a significant period of time from when a product is added to a basket to when they convert. Depending on the category, this can be between 30 and 40 days, this is a key period where your efforts to drive brand consideration could pay off.

One theory about why this latency is occurring is that people are keeping items in their baskets while waiting on price drops. Essentially you add a bunch of things to your basket and see if the price changes or deals are released. People are also using their baskets simply as a holding place for products you want to buy, while you wait for the right moment, such as pay day. Therefore, marketers must monitor their price versus competitors.

Of the top 22 retailers in the US, Amazon has an 80%+ share of purchases and customers are shopping with them more often (5.33 purchases per shopper in July vs. 2.37 on Walmart). Looking at ChannelSight’s data, we also know that Amazon is the most selected retailer within their Buy Now solution (72% of revenue). It has recently been reported that they represent closer to 50% of e-commerce revenue, which confirms that there is a substantial amount of sales coming from the outside the top 22 retailers as well.

Customers are notably loyal in where they shop online, and in FMCG categories they are least likely to shop around. Looking at UK cross-visitation from Jumpshot’s data in the electronics category, we can see that 20% of customers that have looked at products on Tesco have also looked at products on Currys. However, in the beauty category we don’t see as much cross over – just 3% of customers that viewed products on Amazon also looked at beauty products on Superdrug. Similarly, in the food category, there is limited cross-visitation happening amongst grocers. Of those customers that viewed products on Tesco, only 1.1% also viewed Waitrose.

Since you can’t necessarily influence a customer’s preferred retailer, or way of buying, you need to focus on communicating your products’ key points of differentiation to influence what they add to that basket and convert.

What marketers should do next

Start with your own data to inform your retailer efforts:

• Share of sales across your portfolio by product or range

• Profitability of each product and its share of basket at a retailer

• Using where to buy or buy now to identify retailer preference

• Evaluate your competitive positioning (ie. Price, assortment, stock)

At a minimum you need to have the basics of a partnership in place:

• Understanding of retailer product page templates and requirements

• Make sure that you provide robust product information

• Include more than one image of your product

• Increase the number of ratings & reviews

For more advanced content integration:

• Build bespoke connections with retailer CMS or PIM systems for ease of update

• Update your commercial agreement to allow for flexible ways of working

• Identify key contacts at a retailer to discuss DMP or personalisation integrations

• Incorporate clear terms for more agile ways of

SIGN UP FOR ZENITH INSIGHTS