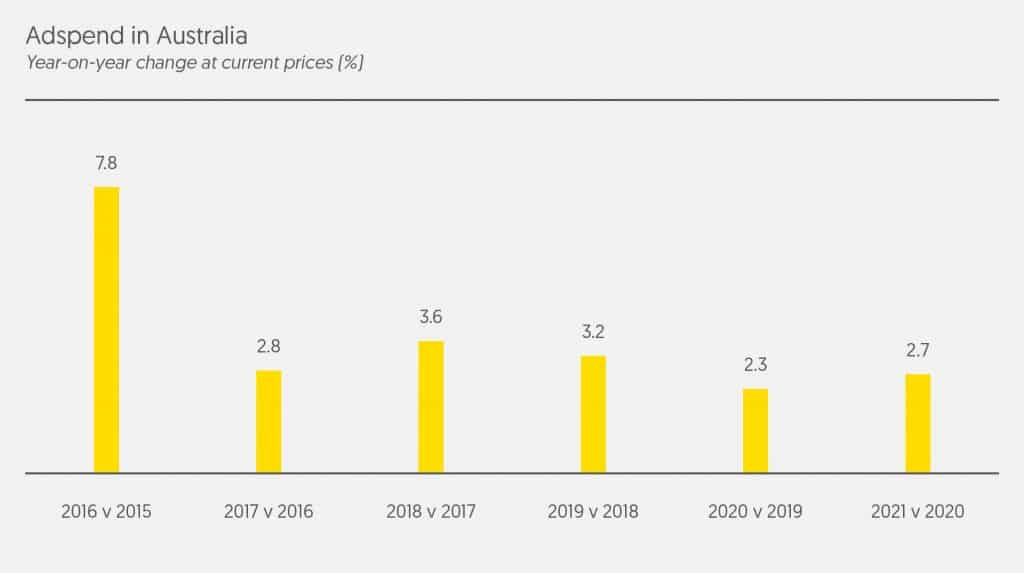

Following a downturn in advertising spend during the second half of 2018, particularly across television, we expect the Australian ad market to grow slightly below expectations in 2019 at 3.5%.

Television had a buoyant first half of 2018 – with Metro TV reporting 5.5% growth over the period – but decline in the second half meant that TV ended the year down by almost 3%. We estimate Metro TV remained very slightly ahead of 2017, and that regional and subscription TV revenues dropped to a much larger extent than originally anticipated.

In light of this, and the results we have seen so far in 2019, we have also downgraded our 2019 TV forecast. Growth will largely come from the Government (NSW and Federal elections in the first half of 2019) and Banking (fall-out after Royal Commission into Misconduct in Banking) categories.

Audiences continue to fragment, using different viewing platforms to access a growing array of content providers. As older age brackets ‘catch up’, linear supply will continue to shrink, resulting in inflation – we predict in the region of 5% every year. Though TV will continue to provide strong ROI for mass/older demographic groups, we are likely to see this change for millennials and Gen X, further propelling the TV networks’ focus on digital solutions.

We expect moderate but steady growth from the radio market, which should also benefit from increased government spending in 2019.

Our newspaper forecast for 2019 is slightly more optimistic than it was, following reports from News Media Index of a slowdown in revenue decline.

Though some in the out-of-home industry expect double- digit growth over the next few years, our predictions are slightly more conservative, particularly following the recent announcement of an investigation into potential malpractice in the industry by the ACCC.

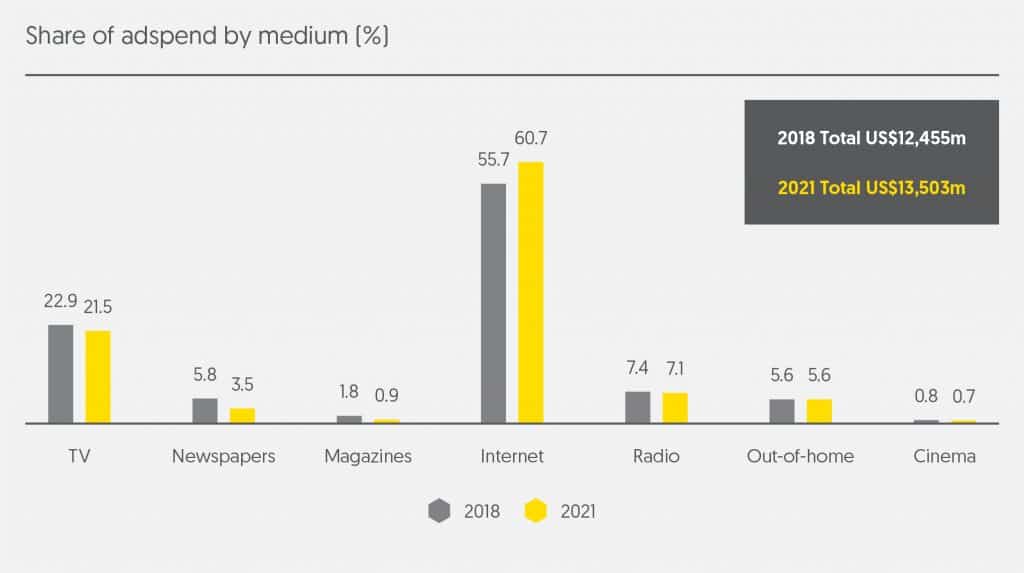

Digital advertising continues to grow at a ferocious pace; indeed, by 2021 we think its share of spend will exceed 60%. Brand safety and transparency concerns over the past couple of years have not dampened advertisers’ enthusiasm for the medium, although we foresee the majority of inflation coming from ‘brand-safe’, premium environments where demand is continually growing but inventory is still in limited supply.

SIGN UP FOR ZENITH INSIGHTS