Internet advertising is booming, and will account for 52% of global advertising expenditure in 2021, smashing past the 50% mark for the first time and well up from the 47% of global adspend it will account for this year.

Internet advertising has been growing at double-digit rates since 2001, and expanded by 17% in 2018 to reach US$261bn. We forecast this total to rise to US$292bn in 2019 and US$350bn in 2021, as it maintains an average annual growth rate of 10% between 2018 and 2021.

This growth is led by the overlapping channels of online video and social media, which are expected to grow

at average rates of 18% and 17% a year, respectively, to 2021. These channels are benefitting from continued technological improvements to smartphone technology, connection speeds, and advertising targeting and delivery, combined with strong growth in investment in content. 5G technology, which launched in South Korea and the US in April and is starting to roll out elsewhere, will further improve brand experiences on these channels by making mobile connections much faster and more responsive.

Much of this growth is coming from small businesses, such as local shops, restaurants, and hobby stores. Platforms like Google and Facebook have opened the ad market up to many small businesses for the first time, by offering simple self-serve tools to create ads and manage campaigns, and provide the localisation and targeting they need to reach their limited potential customer base, converting customers effectively. Small business advertising is rising from a very low base, towards a share of the ad market that better reflects their contribution to the economy: in most countries small businesses contribute half or more of GDP and a larger share of employment. These businesses don’t need to use mass media to create wide awareness – indeed, their customer base is often so limited, by geography or special interest, that using mass media would be too wasteful.

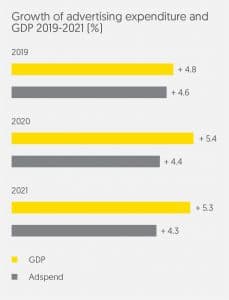

Global adspend to grow 4.6% in 2019, led by the US

We forecast global adspend to grow by 4.6% this year, to reach US$639bn. That’s marginally down from the 4.7% growth forecast in March, but is a strong result given the increased estimates of how much was spent in 2018. Zenith now estimates growth in 2018 at 6.4%, up from its previous estimate of 5.9%, creating a tougher comparative for 2019.

Global adspend is now forecast to increase by US$28bn this year. Almost half this growth (US$13bn) will come from the US, which is benefitting from very rapid growth in internet advertising – at 15.4%, ahead of the global average of 11.7%. China will be the next biggest contributor to growth, adding US$4bn in extra adspend, followed by the UK and India at US$1bn each.