No customer journey is the same, and this requires brands to rethink their organisations.

Influencing a customer’s decision to buy your product is not as straight forward as it used to be. Historically, when a customer was considering which brand to purchase, they turned to the shelf in the bricks-and-mortar shop and prioritised pricing, packaging and brands they were familiar with. This has expanded to include the entire internet, which means ‘the shelf’ has become infinite. Building the optimal consumer hopping experience has become the most important battle ground.

We’ve seen a clear increase in consumers using the internet to both research and purchase products online”

When a customer is deciding whether or not to buy, they consider brands in many different ways. This could be through online research, offline advertising, in-store promotions or from social influencers. The only thing that is certain is that you cannot control how a customer gathers information about your product – no customer’s path to purchase is the same.

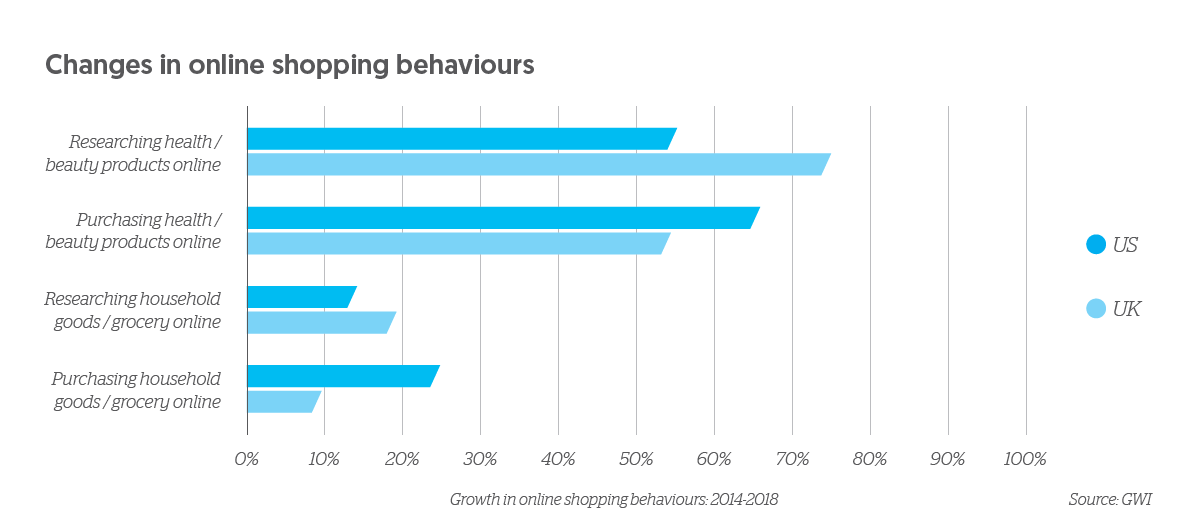

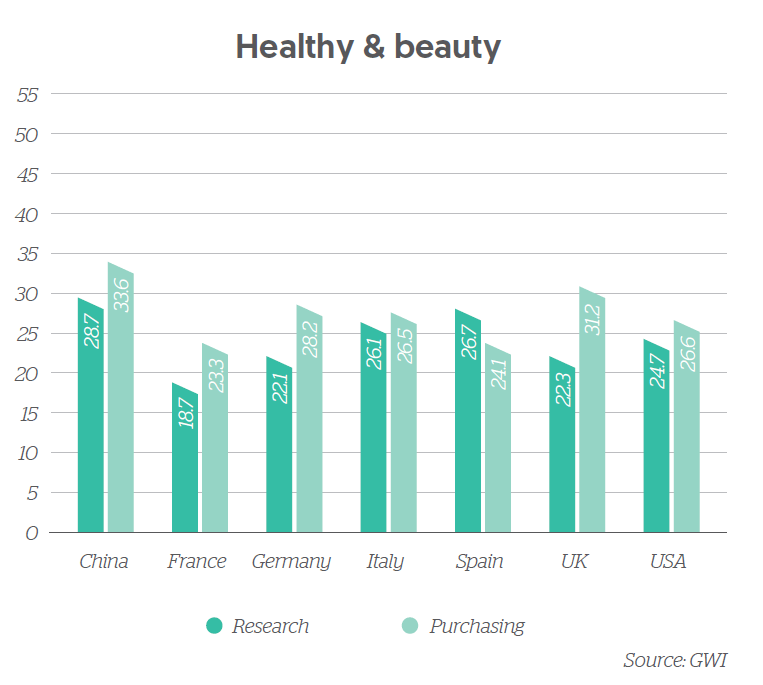

While it varies by market and by category, we’ve seen a clear increase in consumers using the internet to both research and purchase products online, as shown in the chart above.

GlobalWebIndex research shows that in the health/beauty category, customers are purchasing online more often than researching. For example, 31% of internet users have purchased health/beauty products in the UK but only 21% have researched, indicating that they are more likely to be influenced offline or to have already decided which product to purchase, given their loyalty to a brand or influence from other channels. This means that the physical point of sales needs to be a physical point of experience, moving away from the traditional influences on the shelf to a more interactive opportunity.

It is clear that in-store remains a key source of brand discovery across all these markets – being especially effective in the UK (24% of internet users) and US (30%) according to GWI. In-store promotions are actually more effective than pre-roll video ads and updates on brands’ social media pages, showing how the physical store itself has a role to play in marketing/advertising strategies. This still varies by category. Almost half (46%) of shoppers that Dunnhumby surveyed claim to still look for food inspiration when in-store, and only 3% of shoppers surveyed considered online reviews and comparison sites to be the most influential factor in their last purchase of a new food product or brand.

However, in categories where customers are researching online, they are now more likely to go straight to Amazon (54% of searches) rather than Google (46% of searches), compared to 2015 when it was the other way around, according to Jumpshot data.

Integrating your online and offline sales data to optimise your marketing efforts can drive as much as 4x more sales”

This creates even more complexity now that the large marketplaces are playing in the ‘brand awareness’ space and are best suited to drive directly to sale. Aside from their paid advertising solutions, the marketplaces little opportunity to influence a customer’s consideration in those situations, especially if they prioritise their own products and own all the data.

It’s clear that every situation is different and that brands need to structure themselves to meet customer needs, throughout the path to purchase and in a consistent way both online and offline. Criteo reports that integrating your online and offline sales data to optimise your marketing efforts can drive as much as 4x more sales. This integration should include your direct sales and your indirect sales through retailers or marketplaces.

What marketers should do next

• Leverage specialists from Marketing & Sales to inform your respective strategies

• Develop cross functional models to influence your overall budget allocations

• Commercial investments with retailers are starting to blend with media investments and need to be transparent

• Until you optimise your online and offline experience, any growth from comms is at risk of being lost

SIGN UP FOR ZENITH INSIGHTS