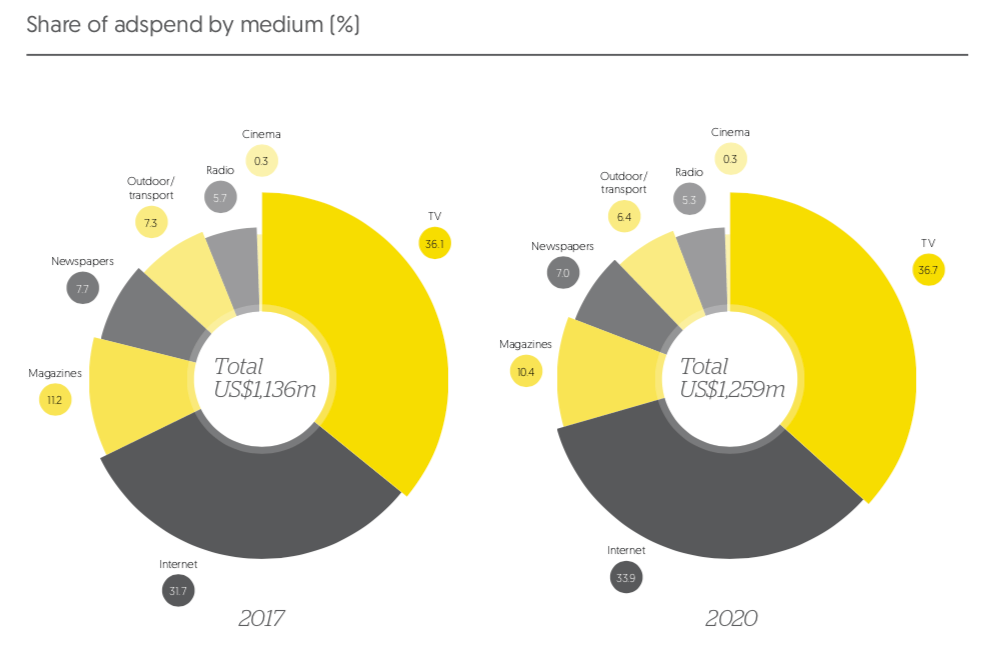

The Czech Republic has a relatively well-developed ad market, with per-capita adspend nearly three times higher than the Central & Eastern European average. Television is the biggest medium,but internet advertising is rising quickly, fuelled by fast-growing search and programmatic display advertising

The Czech Republic’s GDP grew by around 4.3% in 2017, up from 2.6% growth in 2016. Government investment increased, as did household consumption and foreign trade. The Czech economy is currently benefiting from favourable internal as well as external conditions, including an extremely low unemployment rate. GDP growth is expected to come in at 3.5% for 2018 as a whole.

Last year the TV ad market grew by 6.5%, and we expect further growth of around 4% a year throughout our forecast period. The Nova Group took over from the CT Group as leading broadcaster in the first half of 2017, attracting 30% of viewing among those aged over 15, compared to 29% for the CT Group. Prima Group was third with 21%.

The biggest advertising sales point is Media Club, which represents the Prima Group and Barrandov Group channelson TV, as well as various websites, radio stations and magazines. Its television channels carry the most ads in prime time, which has contributed to some loss of viewing share in recent years. To compensate for this Media Club has started including channels from Atmedia in its bundles.

Print advertising grew again in 2017, after growing in 2016 for the first time since 2010. Newspaper adspend grew by 2.0% and magazine advertising by 2.5%. However, circulation and readership continue to fall, and have reached their lowest point this decade. The government has placed newspapers and magazines into a lower-band VAT rate (10%) to try to offer some support.

To compensate for their lower circulation revenues and uncertain ad revenues, publishers have diversified their portfolios with supplements and special editions in print, and tablet, smartphone and e-book products. They have also been responsive to advertisers‘ demand for creative advertising opportunities that help them stand out from the crowd.

Radio adspend has been growing since 2014, despite declines in audience sizes at most of the top stations except čro 1 radiožurnál. A change in measurement methodology meant that culture and leisure became the biggest advertising category in radio in 2014, but retail was the biggest last year.

After acquiring several other outdoor companies, Bigboard now dominates the outdoor advertising market, alongside JCDecaux. Competition between the two is fierce, particularly in Prague. Contractors were legally required to remove all advertising sites next to roads and motorways by September 2017. JCDecaux complied, although Bigboard left sites in place, leaving them empty of advertising, while it awaits the results of an appeal. No new sites are being built, but some existing sites are being converted to digital, while poor sites are being removed. Digital sites are not being used to their full potential because agencies have not yet adjusted to the unique nature of digital outdoor, resulting in poor creative executions. We expect outdoor spend to drop by 3.0% in 2018.

Internet penetration in the Czech Republic is one of the highest in Central & Eastern Europe, at 88%. Seznam is still the top supplier of display advertising, with the most users and highest ad revenues. Google leads in performance marketing.

Real-time bidding is becoming more common, and those who have experience with programmatic buying are now focusing on advanced remarketing, and using third-party data for targeting.