We forecast global advertising expenditure to grow by US$75bn between 2017 and 2020. US$32bnof that will come from Asia Pacific.

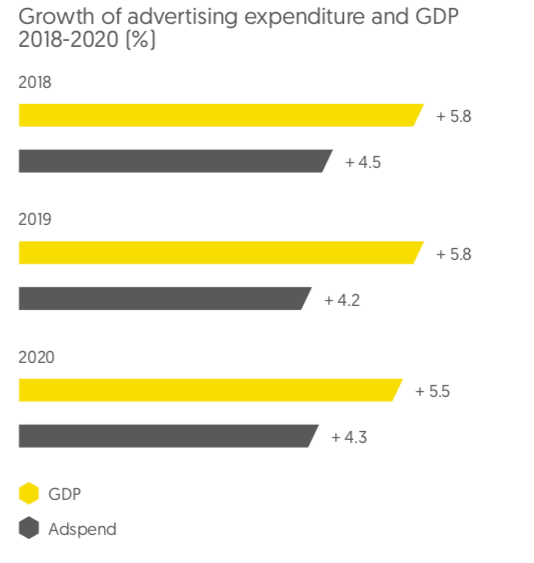

In our latest Advertising Expenditure Forecasts report, we forecast 4.5% growth in global adspend this year, followed by 4.2% growth in 2019 and 4.3% growth for 2020. Growth will therefore remain comfortably within the 4%-5% range it has stayed in since 2011. Asia Pacific is by far the biggest contributor to this growth, supplying 43% of all the new ad dollars added to the market between 2017 and 2020.

We divide Asia Pacific into three separate blocs, based on the similarity of the performance of their ad markets as well as their geographical proximity: Fast-track Asia, Japan and Advanced Asia.

Fast-track Asia is characterised by economies that are growing extremely rapidly as they adopt existing technology and practices and innovate new ones, while benefiting from the rapid inflow of funds from investors hoping to tap into this growth. This includes big markets like China, India and Indonesia, as well as Malaysia, Pakistan, Philippines, Taiwan, Thailand and Vietnam. Fast-track Asia has enjoyed high single-digit or double-digit growth since 1996. Growth is slowing now that some of the region’s markets, notably China, have achieved substantial scale, but we still expect growth to rise to an average of 7.5% a year to 2020.

Japan behaves differently enough from other markets in Asia to be treated separately. Despite recent measures of economic stimulus, Japan remains stuck in its rut of persistent low growth. We forecast average adspend growth of 1.9% a year between 2017 and 2020, behind the average annual growth rate of 2.5% between 2012 and 2017.

Apart from Japan, there are five countries in Asia with developed economies and advanced ad markets that we have placed in a group called Advanced Asia: Australia, New Zealand, Hong Kong, Singapore and South Korea. These markets have performed erratically over the last few years, but have generally grown faster than Japan and considerably slower than Fast-track Asia. We forecast 3.4% average annual growth to 2020, ahead of the 3.1% average growth rate since 2012.

We expect Asia Pacific to account for 33.8% of global adspend in 2020, up from 32.6% in 2017. North America will remain the largest advertising region, contributing 36.0% of global adspend in 2020, but it is growing at an average rate of 3.2%, and the gap between it and Asia Pacific is narrowing all the time.