After several years of decline, Singapore’s ad market is forecast to pick up speed over the next few years. The economy grew better than expected in 2017 due mostly to a strong showing in electronics. In this tech smart market, it is digital spend that will drive the market forward.

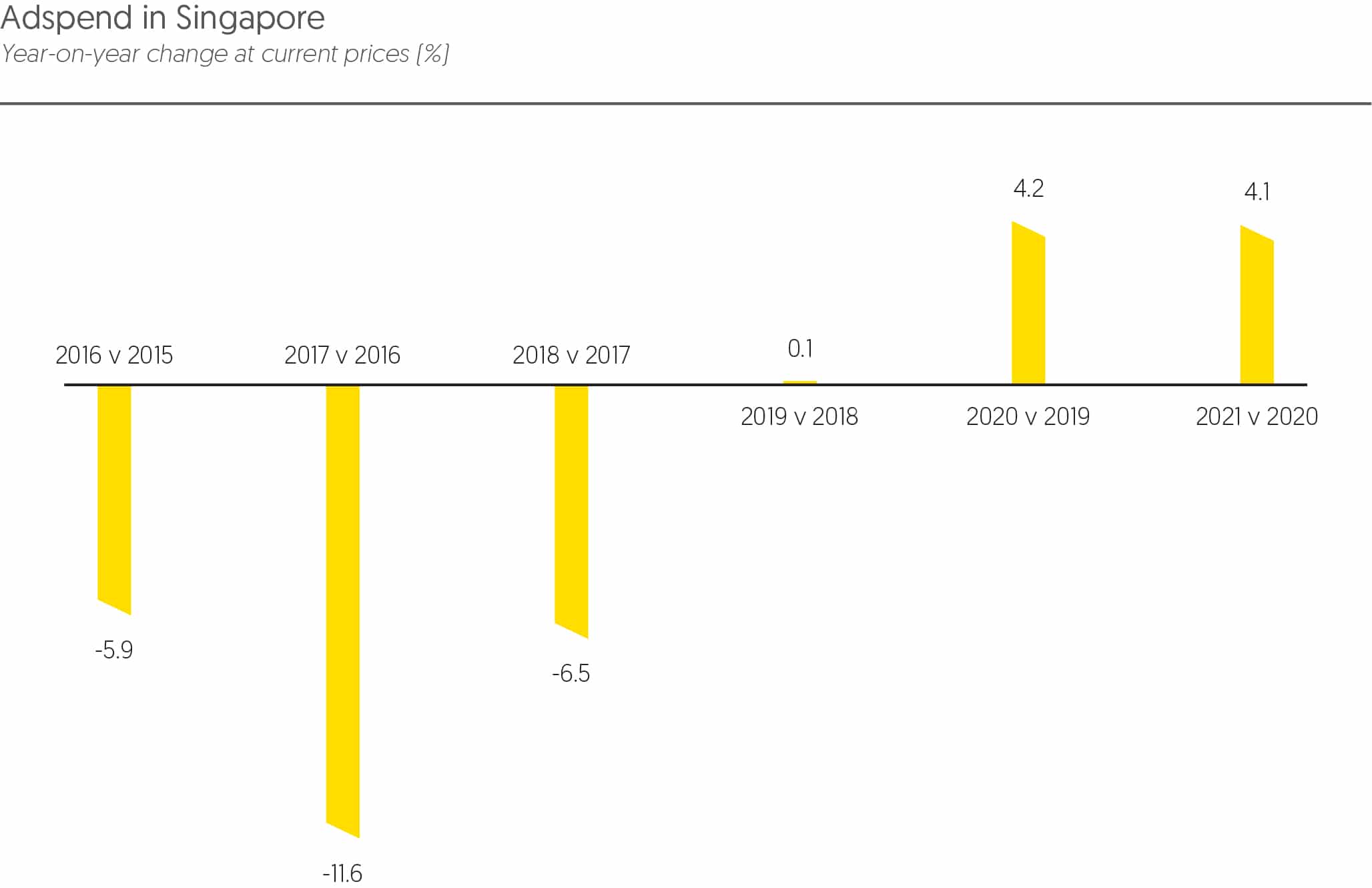

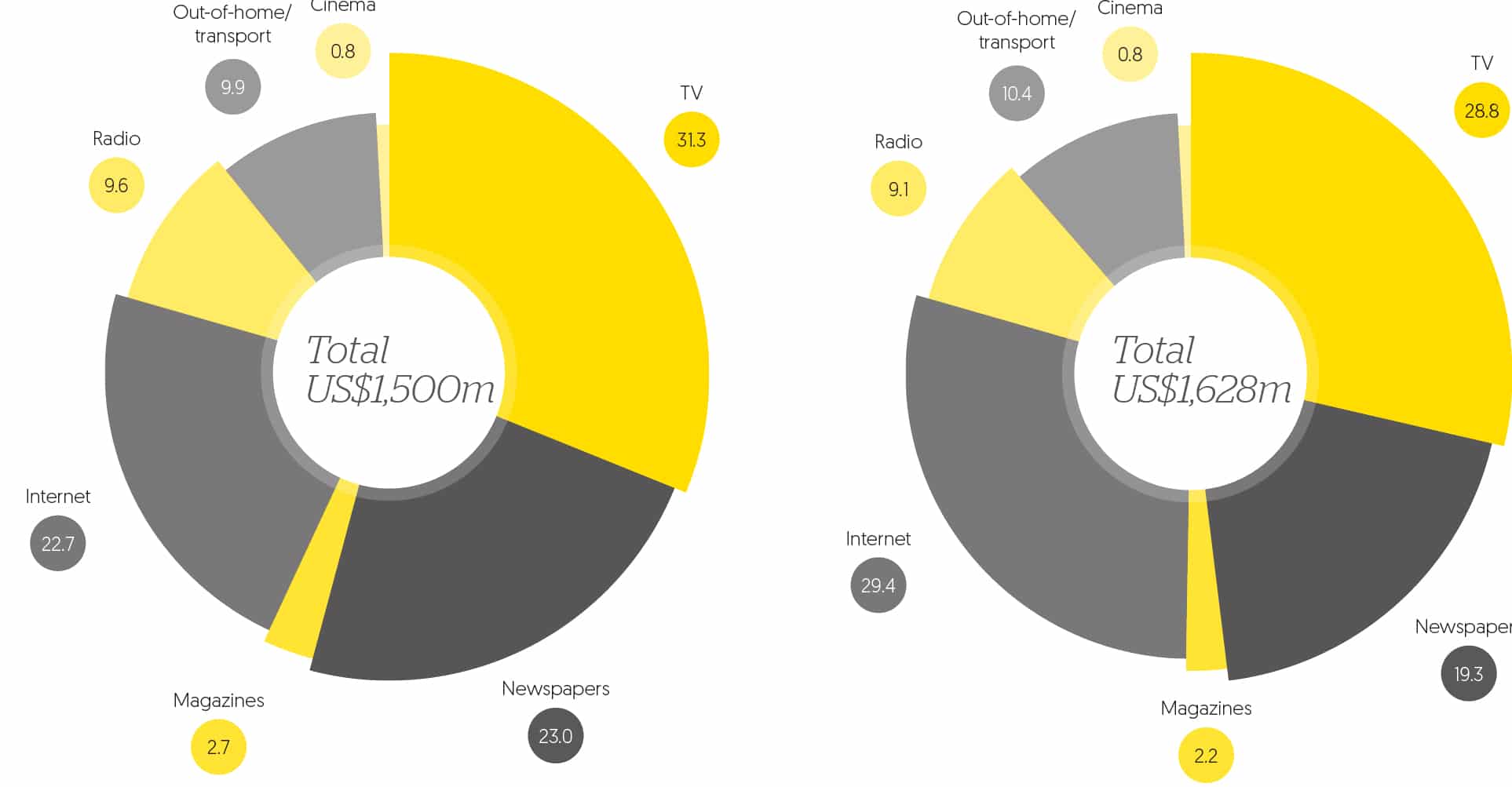

Tracked advertising expenditure across print, TV, radio and selected out-of-home sites reached S$1.77 billion in 2017, a 17% decline year-on-year. A good performance by digital (estimated to have grown by 20%) helped to soften the impact. Total adspend declined by 11.6% to S$2.217 billion in 2017. 2018 full year ad spend is projected at S$2.072 billion, a 6.5% decrease overall.

Growth in digital dropped in 2018 as advertisers focused more on building internal digital and data infrastructure. Traditional internet advertising expenditure was also being diverted to content production and influencer engagement, which are not picked up in the expenditure figures. Privacy concerns and concerns over advertising on inappropriate content have led to reduced investments on Facebook and Google by key global advertisers.

Competition is intensifying in the digital video sector, as content providers like Netflix enter the market to challenge free-to-air provider Mediacorp and pay-TV providers Starhub and Singtel. The dilution of audience, especially younger tech-savvy viewers, is likely to lead to further pressure on TV’s share of budgets.

Analogue TV transmissions ceased in December 2018. While most households have transitioned to digital TV, and the government has plans to help the rest make the transition, there may be some disruption to TV viewing in early 2019. Another issue is the decision by StarHub – Singapore’s largest pay-TV provider – to close down its cable service in July 2019.

With readership declining in print, advertising spend in newspapers and magazines will mirror this change in consumer habits. Singapore’s largest print media owner – Singapore Press Holdings – announced another round of retrenchment in late 2017 as operating revenue for its core media business fell 13% during the year. Revenue from advertisements declined by 16.9%, while turnover from circulation dipped 5.1%. Meanwhile, Today newspaper has ceased its print edition to go fully digital, and The New Paper has become a five-day publication.

Two new radio licences have been issued to Singapore Press Holdings. Money FM 89.3 launched in January 2018, promising to be the first and only business and personal finance radio station.