E-commerce advertising is well established in China, but is only just starting to get going globally. It has the potential to transform the way brands convert customers online, and provide a substantial boost to the global advertising market.

E-commerce advertising – that is, advertising that sits alongside and within search results and product listings on e-commerce sites – allows brands to communicate with consumers who are actively shopping online. It can act like an in-store display in a bricks-and-mortar store, raising awareness at the point of purchase, or more like a paid search ad, pushing the brand towards the top of the list when the customer searches for a particular type of product.

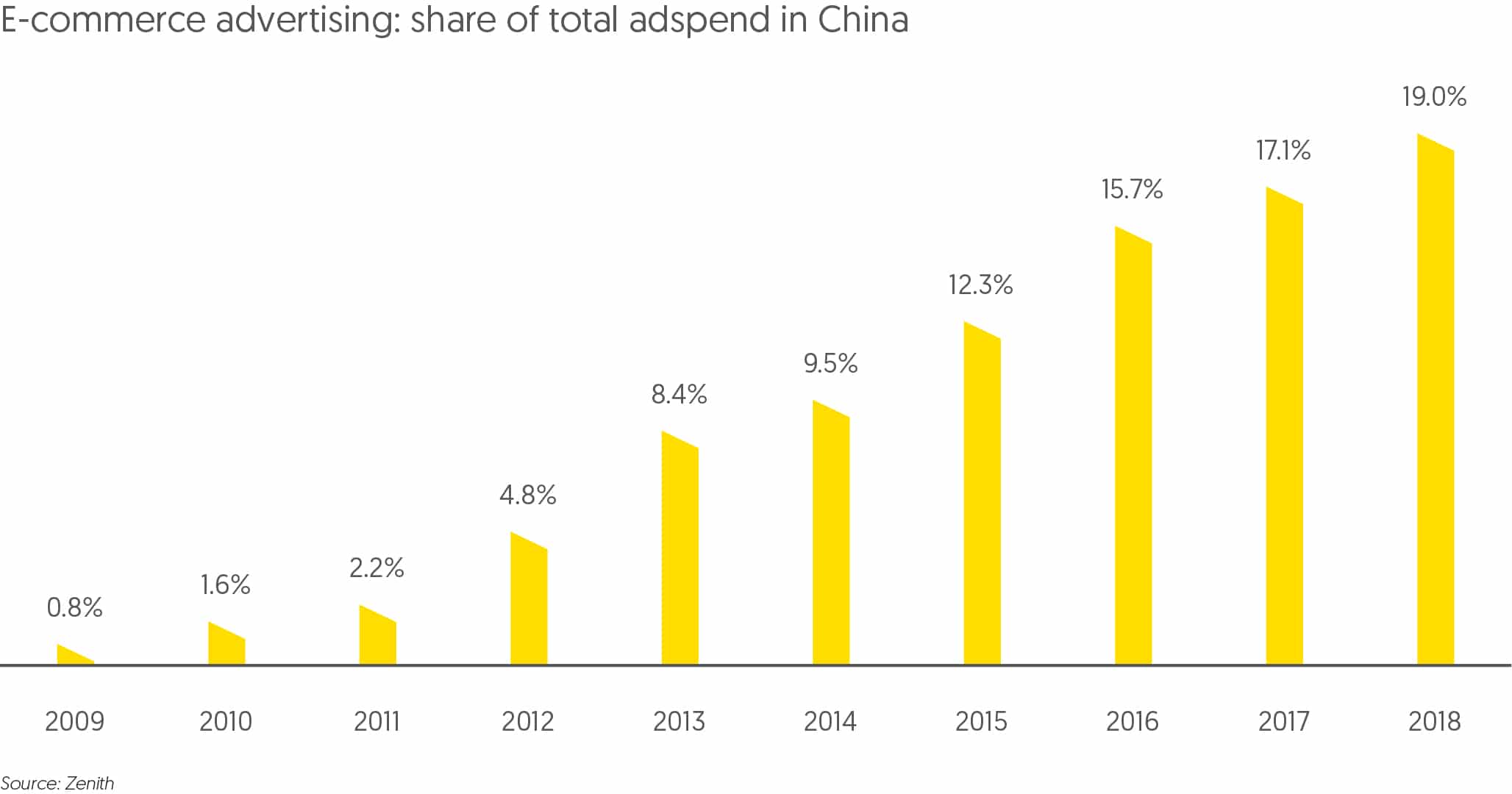

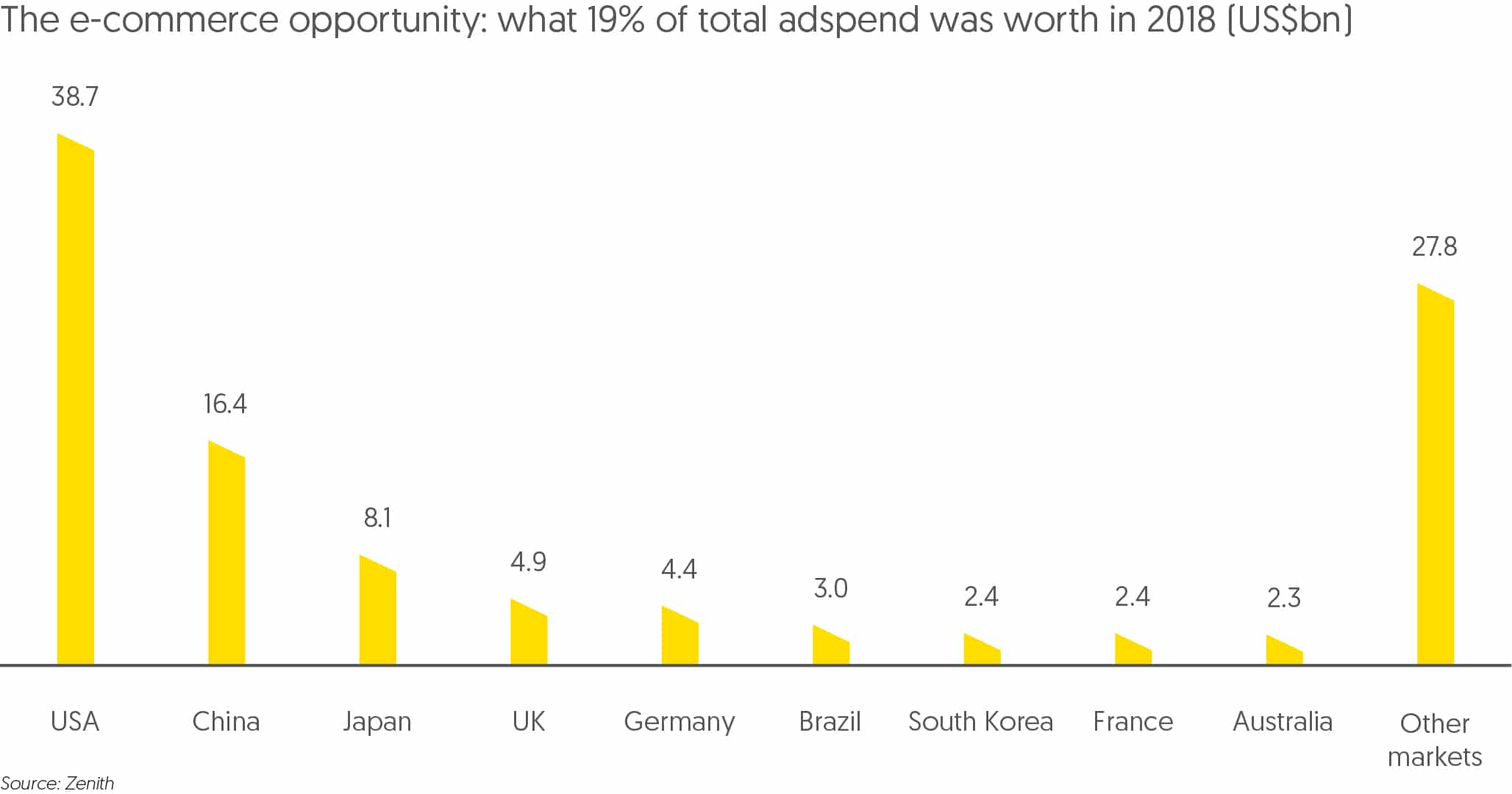

E-commerce advertising has proved wildly successful in China, where companies like Alibaba – now worth more than US$400bn – have made it the basis of their business model. Over the last ten years, e-commerce advertising in China has grown in value from essentially nothing to US$16.4bn in 2018 – that’s 19% of China’s entire advertising market, more than the amount spent on newspaper, magazine, radio, cinema and out-of-home advertising combined. It has rapidly found favour with advertisers eager to connect to consumers at the moment of purchase, from small local businesses to the biggest international brands.

Until recently, e-commerce platforms outside China have largely focused on direct sales to consumers at the expense of advertising, but that is now changing. Amazon generated nearly US$5bn in advertising revenue in 2017, up from US$3bn in 2016. In Q3 2018 alone, Amazon’s ad revenues grew by 122% year on year to reach US$2.5bn, and they are on track to reach about US$10bn for 2018 as a whole. Other shopping platforms are following suit by investing in their own advertising activities. (Note that these figures slightly overstate the size of Amazon’s ad revenues. Amazon only reports its ad revenues as part of an ‘Other revenue’ total, which also includes certain other items such as co-branded credit cards, but these are pretty minor in comparison to its ad business.)

Globally, e-commerce advertising is about as advanced as it was in China at the end of the last decade. Amazon accounted for 0.8% of global adspend in 2017, the same proportion that Chinese e-commerce occupied in 2009. If e-commerce follows a similar path globally to the one it followed in China, it could account for 19% of global adspend by 2027. That’s equivalent to US$110bn in today’s ad market, representing a huge revenue opportunity for the platforms, and a whole new way for brands to reach customers at the point of purchase.

E-commerce advertising has the potential to substantially boost advertising market as a whole. It is typically spent by brands’ commercial teams, which negotiate terms like shelf-space and prominence with retailers, rather than their marketing teams, which normally deal with a brand’s advertising activities. It is therefore new money to advertising, and should expand the market without cannibalising money spent elsewhere. This does create a challenge to an advertiser’s organisational structure, though. To make the most of its e-commerce advertising, an advertiser needs to be able to combine the relevant expertise of both its commercial and marketing teams.

SIGN UP FOR ZENITH INSIGHTS