Online video and paid search are driving the growth in global adspend, as advertisers focus on personalised and targeted communications, according to Zenith’s Advertising Expenditure Forecasts, published today.

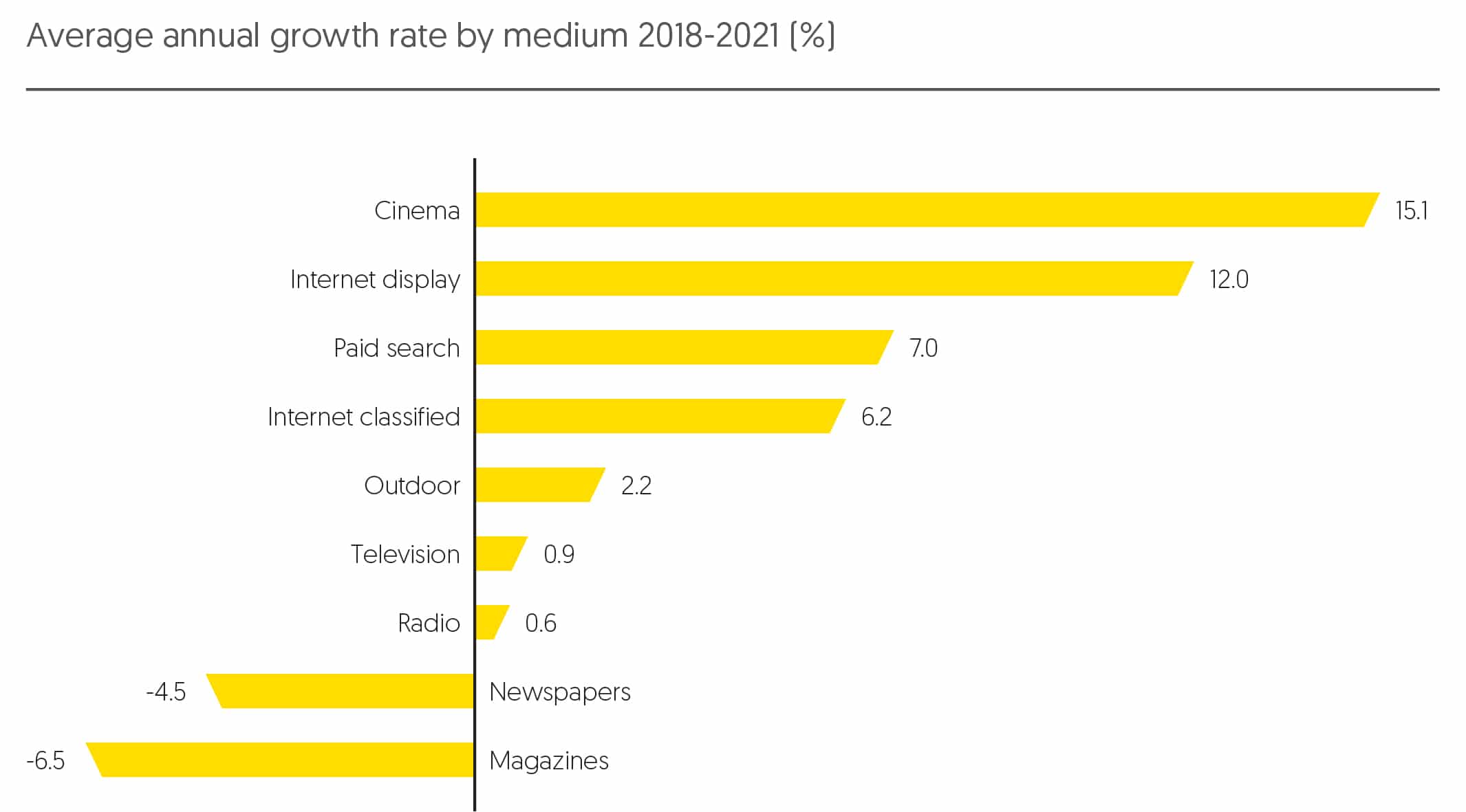

With advertisers now able to use these channels to target with pinpoint accuracy and serve personalised messages, they are increasing both the efficiency and effectiveness of campaigns. Between 2018 and 2021, online video advertising will grow at an average of 18% a year, twice as fast as other forms of internet display advertising and well ahead of any other channel.

E-commerce advertising is poised to transform the advertising market in much the same way that paid search did in the last decade,”

Paid search is not growing as quickly in percentage terms – it will grow at an average of 7% a year over this period – but in dollar terms will contribute even more to global growth than online video. The application of AI techniques, better location targeting, integration with commerce and the rise of ‘in the moment’ search are all making search more effective for advertisers. We forecast that between 2018 and 2021, online video advertising will grow by US$20bn, while paid search will grow by US$22bn. Between them these two channels will account for 60% of the extra ad dollars added to the market over this time.

Online video and television are more important to brand-building than ever

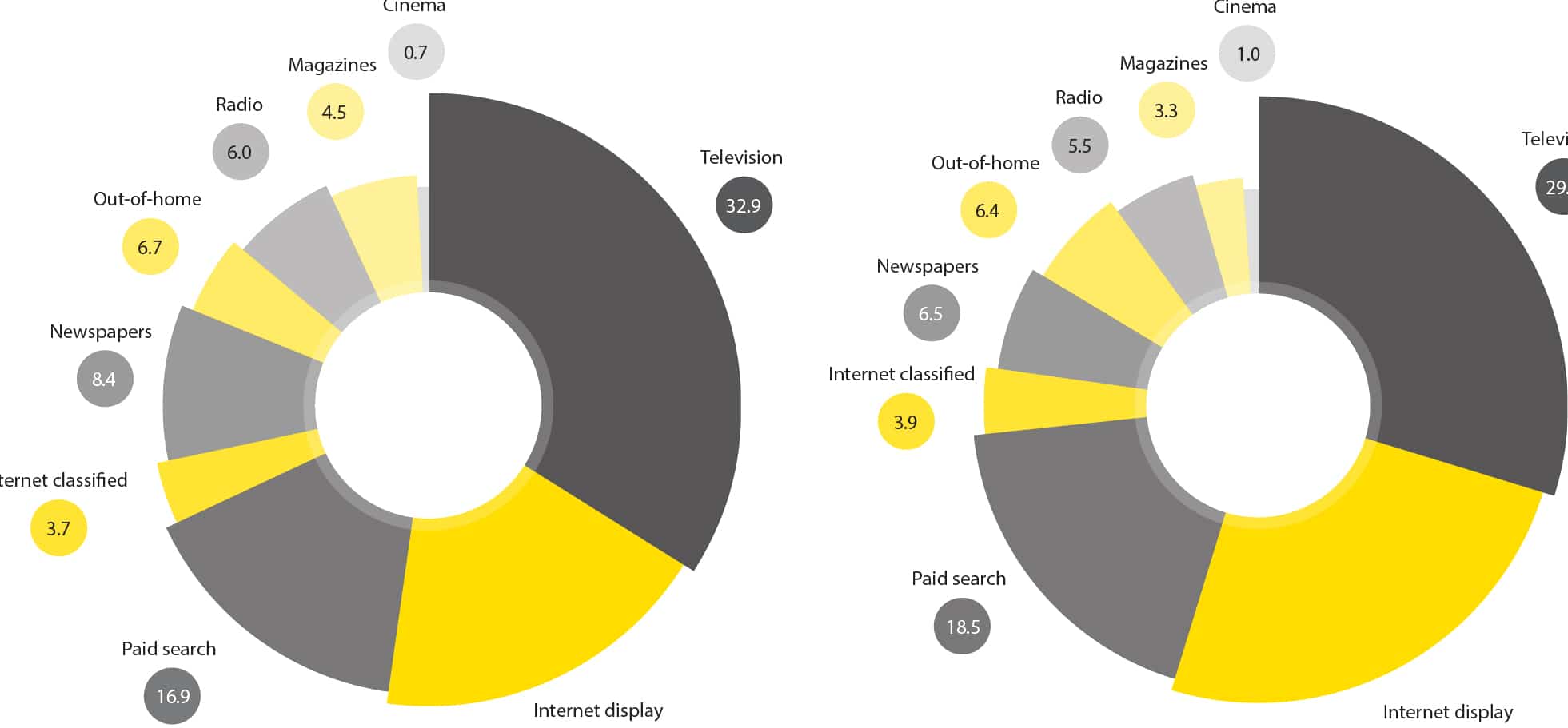

Advertisers commonly use online video together with traditional television, combining television’s broad reach and immersive experience with online video’s ability to target and optimise frequency. Taken together, these two media are becoming more important to advertisers’ brand-building campaigns. Their combined share of adspend in ‘display’ media (i.e. all media except paid search and classified advertising) has risen from 46.2% in 2012 to 48.4% this year. By 2021 we expect television and video to have a combined 48.8% share of global ‘display’ – a higher share than television ever achieved on its own. Taken together, television and online video are working harder for advertisers than ever before.

Global e-commerce advertising starts to accelerate

E-commerce advertising – advertising that sits alongside and within search results and product listings on e-commerce sites – is well established in China, but is only just starting to get going globally. Zenith believes it has the potential to transform the way brands convert customers online, and add about US$100bn of new money into the global advertising market.

E-commerce advertising has risen from 0.8% of all adspend in China in 2009 to an estimated 18.2% this year, driven by investment by companies like Alibaba in turning e-commerce into advertising revenue. Until recently, e-commerce platforms outside China have largely focused on direct sales to consumers at the expense of advertising, but that is now changing. Amazon generated nearly US$5bn in advertising revenue in 2017 as a whole, and in Q3 2018 its ad revenues grew by 122% year on year. Other shopping platforms are following suit by investing in their own advertising activities.

Globally, e-commerce advertising is about as advanced as it was in China at the end of the last decade. Amazon accounted for 0.8% of global adspend in 2017, the same proportion that Chinese e-commerce occupied in 2009. If e-commerce follows a similar path globally to the one it followed in China, it could account for 18% of global adspend by 2027. That’s equivalent to over US$100bn in today’s ad market, representing a huge revenue opportunity for the platforms, and a whole new way for brands to reach customers at the point of purchase. This money typically comes from brands’ commercial teams rather than their marketing teams, from budgets set aside for negotiating with retailers. It is therefore new money to advertising, and should expand the market without cannibalising money spent elsewhere.

Steady growth in global adspend to continue

We estimate that global advertising expenditure will grow 4.5% by the end of this year, boosted by the Winter Olympics, FIFA World Cup and US mid-term elections. Growth will then remain steady and positive for the rest of our forecast period to 2021, at 4.0% in 2019, 4.2% in 2020 and 4.1% in 2021.

Central & Eastern Europe will be the fastest-growing region, with average growth of 6.3% a year between 2018 and 2021, driven by continued strength in Russia, which is growing at 6.8% a year and accounts for 39% of the regional total. Asia Pacific is next, growing at an average of 4.9% a year, or 5.7% a year excluding Japan. India is the stand-out growth market here, growing at 13.5% a year from US$9.7bn in 2018 to US$14.2bn in 2021, when it will become the world’s eighth largest advertising market, entering the top ten for the first time. India has huge potential for further growth, with advertising taking up just 0.3% of GDP, less than half the Asia Pacific average of 0.7%

“Brands are transforming their businesses to take advantages of the new digital opportunities available to them,”

Young advertising markets like India are playing an ever-more-important role in driving global growth in adspend. ‘Mature’ markets – by which we mean North America, Western Europe and Japan – account for 62% of global adspend this year, down from 75% ten years ago. ‘Rising’ markets – by which we mean all markets apart from the ‘Mature’ ones – will contribute 54% of the growth in global adspend between 2018 and 2021, increasing their share of global expenditure from 38% to 40%.

“E-commerce advertising is poised to transform the advertising market in much the same way that paid search did in the last decade,” said Jonathan Barnard, Zenith’s Head of Forecasting and Director of Global Intelligence. “It could bring US$100bn in new money into the market over the next ten years.”

“Brands are transforming their businesses to take advantages of the new digital opportunities available to them,” said Vittorio Bonori, Zenith’s Global Brand President. “Better segmentation and targeting, personalised creative and direct transactional relationship with consumers are combining to drive brand growth.”

SIGN UP FOR ZENITH INSIGHTS