Marketing imperatives

- For auto brands, television is still the most important medium for paid advertising, particularly because new car buyers are heavy viewers

- Most consideration now takes place online, so brands need to concentrate their attention here where it can make the most difference

- Search, social and video ads are highly effective and becoming even more so

The automotive industry is one of the biggest spenders on advertising. Five of the world’s twenty biggest advertisers are automotive brands, according to Advertising Age, spending a total of US$22bn a year between them. Like other industries, the automotive industry is having to respond to changes in the way consumers encounter, choose between and shop for brands, which have been brought about by new technology.

In particular, people who are shopping for cars are more likely to spend time researching cars independently – largely online – and seeking other people’s opinions, before trying any cars out in person. The number of times that people visit dealers before making their purchase has dropped steadily over time, and in many cases the buyer has made up their mind before making a single visit to a dealership to make the purchase.

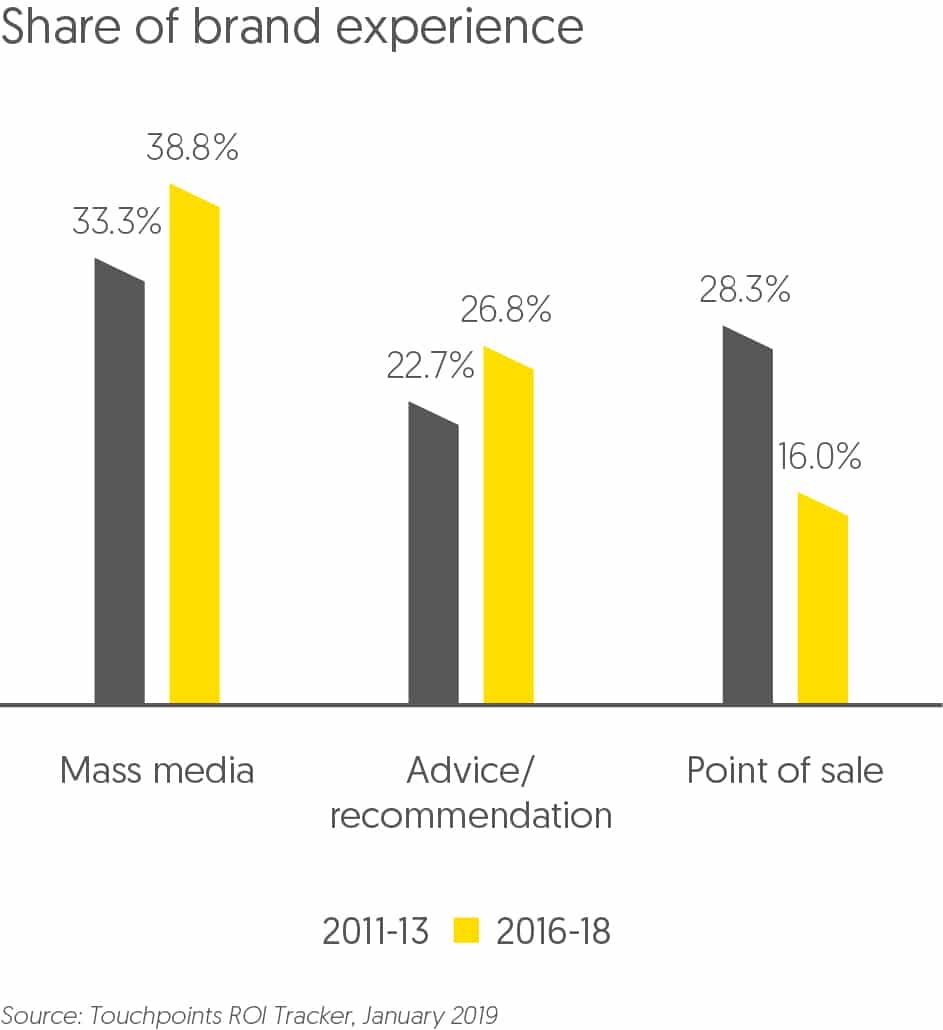

We use our Touchpoints ROI Tracker tool to monitor trends in brand communication over the full range of paid, owned and earned touchpoints. One of its outputs is Brand Experience, which measures the reported importance of each touchpoint in shaping consumer attitudes and influencing consumer behaviour. As the chart below shows, the importance of point-of-sale touchpoints has fallen by nearly half over the last five years, while the importance of mass media and advice/recommendation has increased markedly.

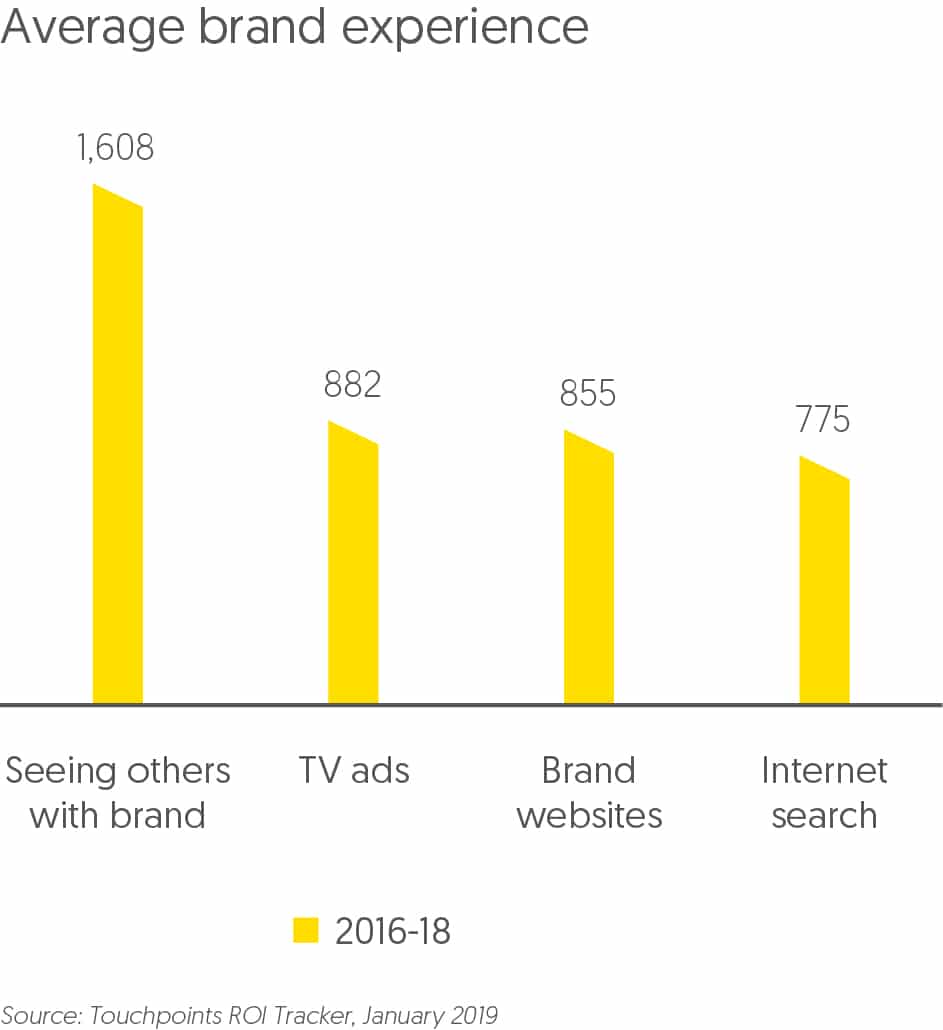

The single biggest contributor to consumers’ experience of car brands is seeing other cars on the road. Market share is therefore to an extent self-reinforcing. But the second-biggest is television ads, hence the heavy investment by most brands in high-quality television campaigns. It’s true that audiences are shifting from traditional, scheduled television to various forms of online video, but this has been most pronounced among younger audiences. The target audience for new car sales skews older – even for lower-end brands, new car buyers are typically over 45 – and for these audiences television retains most of its reach.

The third and fourth-most important touchpoints for shaping consumers’ experience of brands are online touchpoints. Like all categories, the automotive industry has experienced a large-scale shift of brand experience from offline to online touchpoints, but here the shift has been particularly rapid. The online share of brand experience has essentially doubled, to reach 40%, in just five years. Online touchpoints now make up the bulk of the consideration phase of the path to purchase, as consumers investigate brands, seek out expert opinions and scan reviews from other consumers. Brands are therefore shifting their paid media budgets online, to influence consumers where they are most receptive.

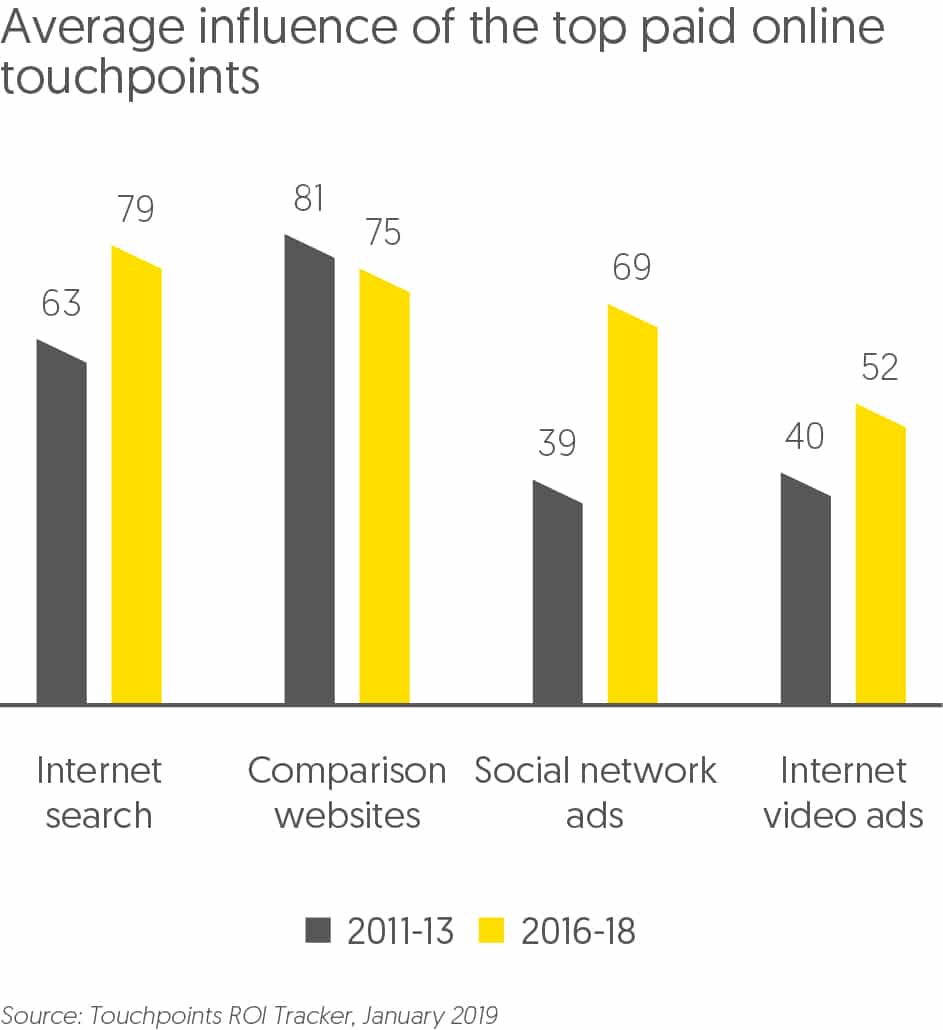

Our Touchpoints ROI Tracker also measures the influence of individual touchpoints – i.e. how likely they are to change consumers’ beliefs and behaviours. Internet search, comparison websites, social network ads and internet video ads are the most influential paid online touchpoints. All but comparison websites have become substantially more influential over the last five years, particularly social network ads. As well as using social networks for brand awareness ads, brands are also using them to amplify positive reviews by experts and consumers, and to promote test drives, one of the most effective routes to securing the final sale. Brands are also experimenting with new technology like Augmented Reality showrooms to give consumers a better experience of the cars on offer, though these are as yet minor contributors to brand experience.

Based on consumer research, Touchpoints ROI Tracker is Publicis Media’s brand contact measurement and planning tool. Since 2004 a total of 1,190 Touchpoints projects have been completed across 69 countries, comprising 1,045,083 consumer interviews that provide contact point metrics for 15,958 brands in 341 product and service categories. The data for all projects are stored in a single internet-accessible database. This database provides normative and trend data for 301 touchpoints.

All rights to the MCA® measurement system including CCF™, BEP™ and BES™ are owned by Integration (Marketing and Communications) Limited and licensed to Publicis Media Limited and its affiliates.

SIGN UP FOR ZENITH INSIGHTS