Marketing imperatives

- Identify how your customers navigate between their devices

- Evaluate the experiences each retailer provides on different devices

- Understand each retailer’s CRM programme and personalisation options

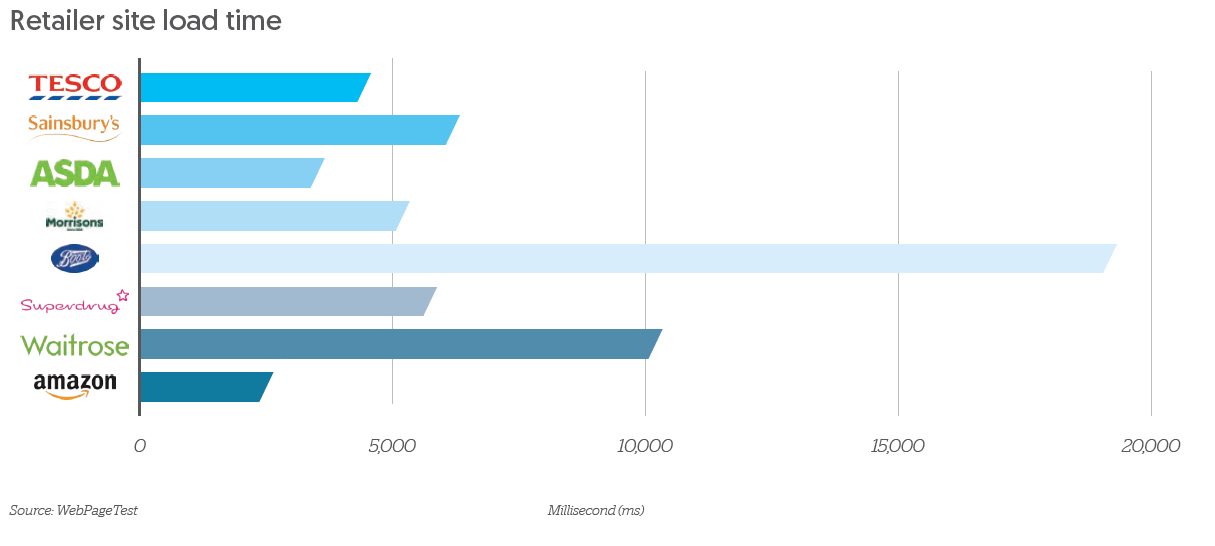

- Check retailers’ page speeds

- Analyse the checkout process and delivery options each retailer provides

Forging e-commerce partnerships with retail websites can be very effective at driving growth. The most important step in building an effective growth plan is choosing the right partners, and to do this brands need to evaluate how their potential partners’ e-commerce experiences cater for their customers’ preferences.

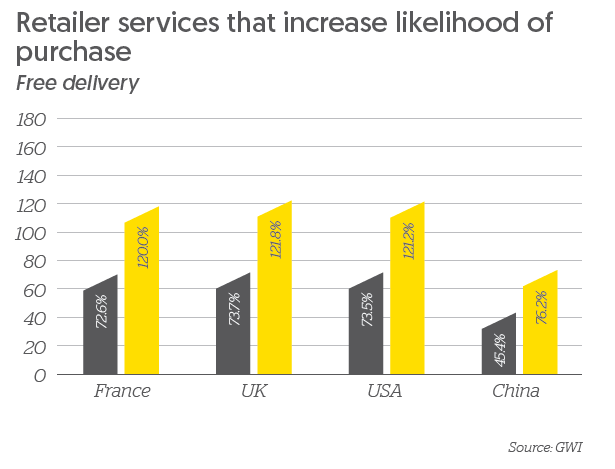

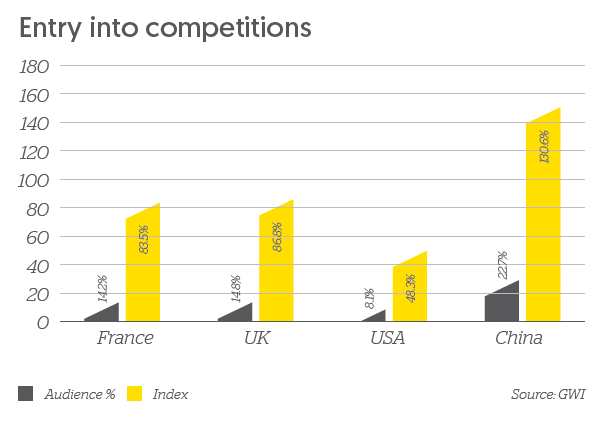

Clearly consumers now expect a connected shopping experience. But the type of experience they respond to best varies from country to country, as well as by category and demographic. In the UK, for example, shoppers favour convenience. According to research conducted by

GlobalWebIndex (GWI) in July 2018, UK shoppers are 36% more likely to value next-day delivery and 84% more likely to value click-and-collect options over the possibility of being entered into competitions. However, in China consumers are 30% more likely to value competition entry over other shopping experiences.

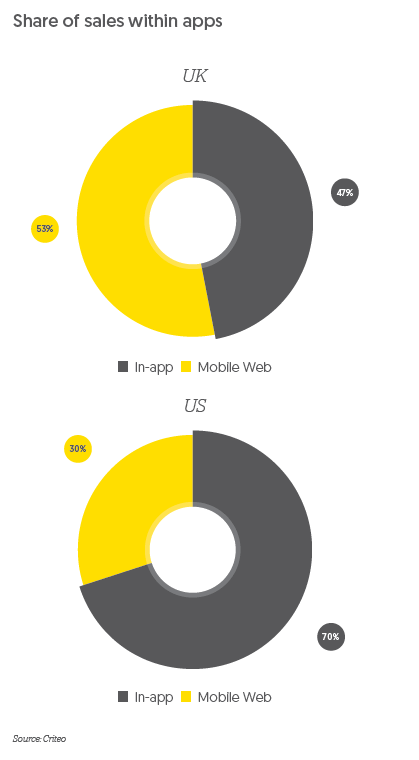

At a basic level, consumers have different preferences for the devices they use to research and purchase products. The GWI survey found that in Germany, for example, consumers are much more likely to use mobile devices to research products than to buy them. 44% of customers in Germany researched a product on mobile but only 27% made a mobile purchase, compared to the 69% of customers who purchased a product on a desktop computer. This is a common pattern in North America and Europe, but habits are very different in Asia. In China, for example, 73% of customers used their mobile devices for research and 71% used them to make a purchase.

It is therefore vital for brands to determine their customers’ preferences for desktop internet, mobile internet and apps, both for research and purchasing, and to find partners that provide experiences that best match these preferences.

Customers also want their experience to be personalised. Dunnhumby has measured a 7% category sales uplift from personalised advertising, both online and in-store. Tesco has identified an increase in conversion rate when customers receive personalised messaging. Here are some successful examples:

- Have you forgotten?: 40% of customers go on to purchase, +1.5% weekly sales uplifts

- Relevant promotions: 30%-50% e-mail open rate, +0.5% weekly sales uplifts

- Healthier alternatives: 10% of customers chose alternatives

- Personalised Christmas lists: 92% conversion rate, 4.8% sales uplift

Brands seeking retailer partners should pay close attention to their ability to identify their customers, determine their shopping preferences, and use this information to tailor their messaging.

The best indicator that something is going wrong with the purchase experience is when the customer adds an item to their online shopping cart but doesn’t complete the purchase. The survey by GWI found that this happened to three quarters of internet users in the UK and the US in July 2018. Page speeds are a big factor in cart abandonment – online customers are impatient and have plenty of alternatives, so if a retailer keeps them waiting they’ll go elsewhere. Tools like WebPageTest or Google’s PageSpeed Insights will test the performance of retailers’ shopping sites and their vulnerability to cart abandonment.

Another critical point of failure is the payment process. A quick and easy checkout is one of the most effective ways to encourage someone to buy something online. In addition to checkout, having a clear returns policy, free delivery options and the option to collect loyalty points are also key drivers of purchase.

SIGN UP FOR ZENITH INSIGHTS