Marketing imperatives

- Identify your customers’ different expectations on different social media channels, and shape your communications to fit

- Monitor conversations about your brand and respond to problems in real time

- Prioritise improving the overall customer experience over chasing followers and likes

Facebook used to be the be-all and end-all of social media for finance brands, which measured their success with straightforward metrics such as the number of likes or shares generated by each post. As the number of successful social platforms has multiplied, however, finance brands have specialised, making use of the particular strengths of each platform to achieve different purposes, and taking a wider view of success. Now finance brands want their social platforms to contribute to their wider aims of improving their reputation and customer satisfaction, while addressing problems as they arise.

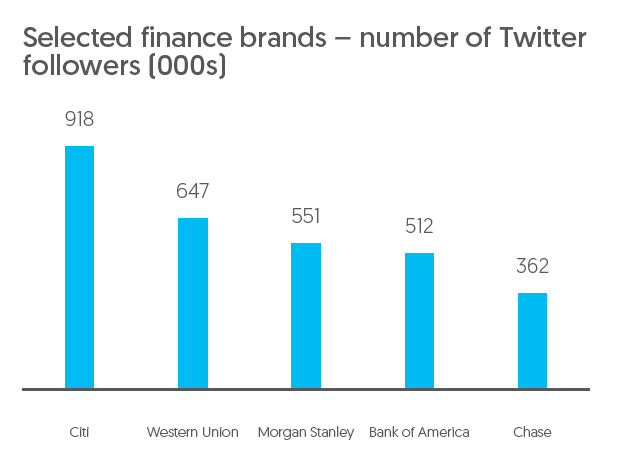

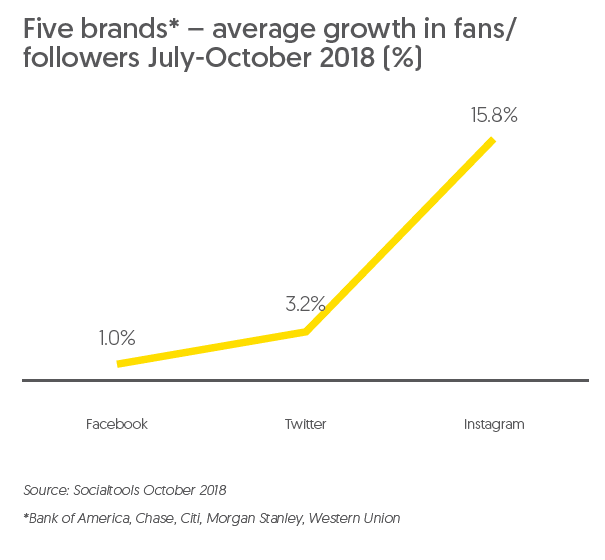

To examine how finance brands are using different social platforms, we chose five representative brands with substantial numbers of fans or followers across all three of Facebook, Twitter and Instagram: Bank of America, Chase, Citi, Morgan Stanley and Western Union. The chart below illustrates their popularity on Twitter.

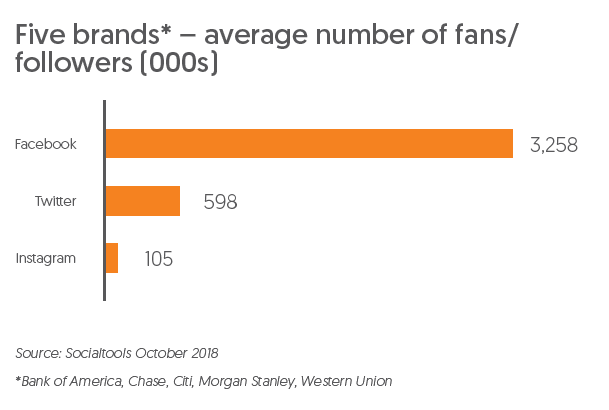

Facebook is very much the platform of mass reach. Across our chosen five brands, their Facebook pages have on average more than five times as many followers as their Twitter pages, and more than 30 times as many as their Instagram pages. Today, finance brands are likely to use

Facebook to provide financial advice, start conversations and illustrate how finance can improve a customer’s life, reaching as many people as possible.

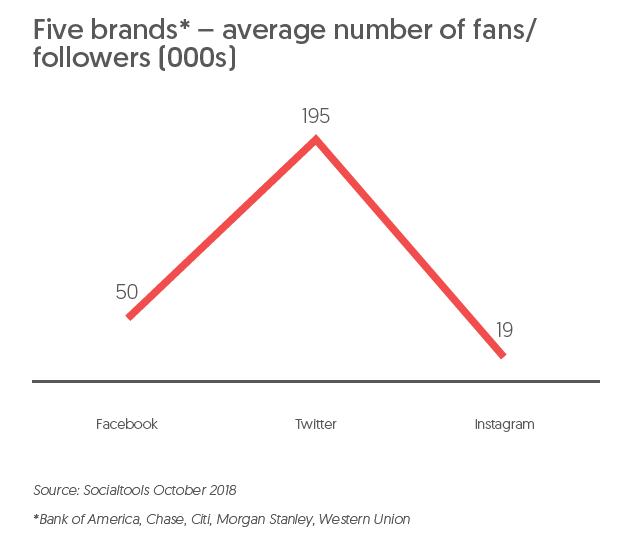

Twitter tends to be more focused on customer service than Facebook – providing specific advice, responding to customers’ tweets and responding to complaints. For many users, Twitter is a place to vent their frustration with poor customer experience, and a proactive brand will

monitor sentiment and respond to problems that arise in real time. Twitter is the high-volume platform, with our five finance brands posting nearly four times more often than on Facebook, and ten times more often than on Instagram.

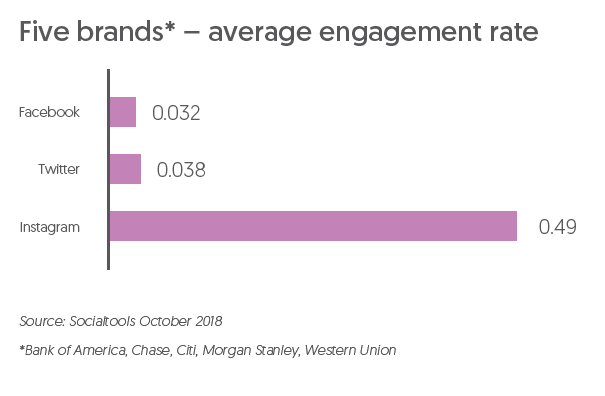

Instagram is more about providing visual inspiration than advice or customer service. While Instagram is in clear third place for number of followers for most finance brands, it does excel in enabling them to engage their followers and elicit active responses. For our five finance brands, Instagram followers are 13 times more likely to engage with a post than Twitter followers, and 15 times more likely than Facebook followers.

With such high response rates from potential customers, it’s no surprise that brands are working hardest to increase their Instagram audiences. Between July and October this year, our five brands increase their Instagram followers five times faster than their Twitter followers, and sixteen times faster than their Facebook followers.

Socialtools is Zenith’s proprietary social content performance tracking tool. Socialtools is currently tracking the daily performance of 177,000 pages across six social platforms (Facebook, Twitter, YouTube, Instagram, LinkedIn and VKontakte), providing evaluation of the effectiveness of social content for brands and their competitors in 195 countries. Socialtools charts show performance trends across a wide variety of social engagement metrics. The brand performance data, norms and rankings provide insights into social media best practices for brands in 21 macro categories and 130 categories.

Socialtools is Zenith’s proprietary social content performance tracking tool. Socialtools is currently tracking the daily performance of 177,000 pages across six social platforms (Facebook, Twitter, YouTube, Instagram, LinkedIn and VKontakte), providing evaluation of the effectiveness of social content for brands and their competitors in 195 countries. Socialtools charts show performance trends across a wide variety of social engagement metrics. The brand performance data, norms and rankings provide insights into social media best practices for brands in 21 macro categories and 130 categories.

SIGN UP FOR ZENITH INSIGHTS