As established financial services brands face new competition from fintech start-ups, they are focusing on crafting emotional brand stories tailored for different audiences, and reaching them where they are most receptive.

The global financial services industry is huge, generating well over US$10 trillion in revenue annually. Financial services firms account for seven of the world’s top 100 advertisers, according to Advertising Age, which spend a total of US$14bn on advertising between them. Adspend

across the sector totals about US$40bn.

Financial services generally arouse few emotions among consumers – except negative ones, when things go wrong. Consumers generally see finance as a tool, a means to an end. Most advertising in the category focuses on brands, rather than products, and tries to forge emotional connections. Brands typically have very broad target audiences – everyone needs a bank. Finance brands therefore concentrate their activity in mass media with broad reach and high engagement.

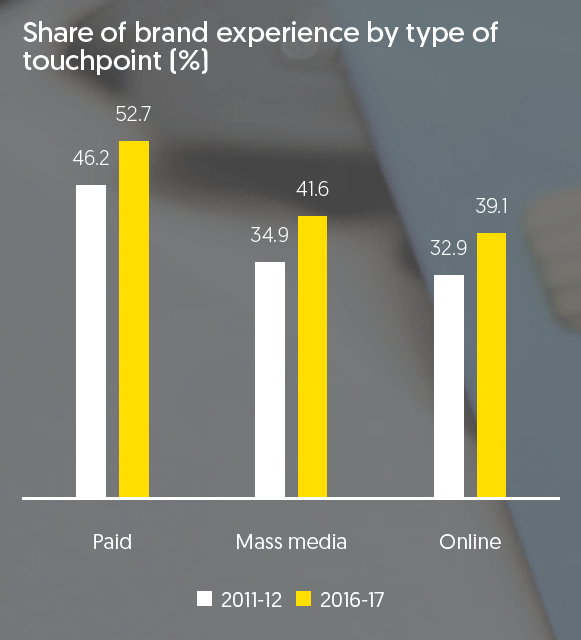

We use our Touchpoints ROI Tracker tool to monitor trends in brand communication over the full range of paid, owned and earned touchpoints. One of its outputs is Brand Experience, which measures the reported importance of each touchpoint in shaping consumer attitudes and influencing consumer behaviour. As the chart below shows, financial brands are highly focused on paid mass media, and they have become more focused over the last few years. Finance was one of the earliest categories to commit heavily to digital media, because a lot of customers began managing their finances primarily online in the last decade. But finance brands have intensified their online activities as channels like online video have allowed them to deliver more engaging, emotion-laden messages to consumers over the internet. Note that the categories in the chart are overlapping, not exclusive, which is why the figures add up to well over 100%.

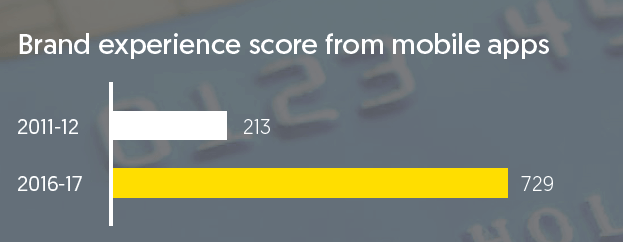

The smartphone has become one of the main battlegrounds for finance brands, with new fintech brands like Revolut and Atom bank designing services built for the mobile from the ground up, and using cutting-edge technology to raise their customers’ expectations of what financial services should deliver. The capabilities and user experience of mobile apps have become much more important to brand experience over the last few years.

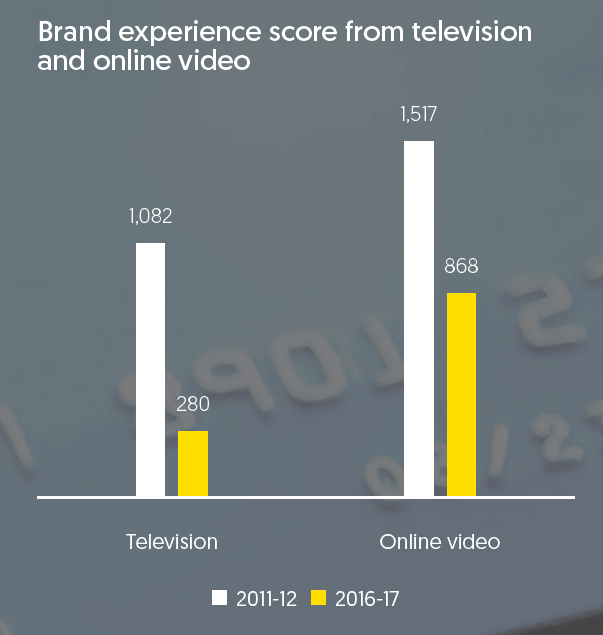

Television ads are the single most important touchpoint for finance brands, with the greatest ability to reach consumers and shape their options. But online video has become an indispensable tool for finance brands in recent years, generally used in concert with television.

Online video can be used to extend the reach of a television campaign among young audiences who are light television viewers. This can be done using the existing television creative, but edited or new creative normally works better, since online viewers have different expectations of ad length and narrative structure. The targeting capabilities of online advertising also allow brands to customise their creative messaging to the stage of the audience’s life, which has a strong influence on people respond to finance brands. While television is universal, online video allows finance brands to be personal.

Based on consumer research, Touchpoints ROI Tracker is Publicis Media’s brand contact measurement and planning tool. Since 2004 a total of 1,167 Touchpoints projects have been completed across 67 countries, comprising 1,025,861 consumer interviews that provide contact point metrics for 15,636 brands in 373 product and service categories. The data for all projects are stored in a single internet-accessible database. This database provides normative and trend data for 294 touchpoints.

Based on consumer research, Touchpoints ROI Tracker is Publicis Media’s brand contact measurement and planning tool. Since 2004 a total of 1,167 Touchpoints projects have been completed across 67 countries, comprising 1,025,861 consumer interviews that provide contact point metrics for 15,636 brands in 373 product and service categories. The data for all projects are stored in a single internet-accessible database. This database provides normative and trend data for 294 touchpoints.

All rights to the MCA® measurement system including CCF™, BEP™ and BES™ are owned by Integration (Marketing and Communications) Limited and licensed to Publicis Media Limited and its affiliates.

SIGN UP FOR ZENITH INSIGHTS