Search is benefiting from the application of artificial intelligence techniques and integration with commerce, while social platforms are starting to compete directly with television broadcasters for video adspend.

We predict that two thirds of all the growth in global advertising expenditure between 2017 and 2020 will come from paid search and social media ads. Over this period, total spending will increase from US$86bn to US$109bn on paid search, and from US$48bn to US$76bn on social media. Paid search will grow by US$22bn over this period, while social media will grow by US$28bn, making it the single biggest contributor to growth.

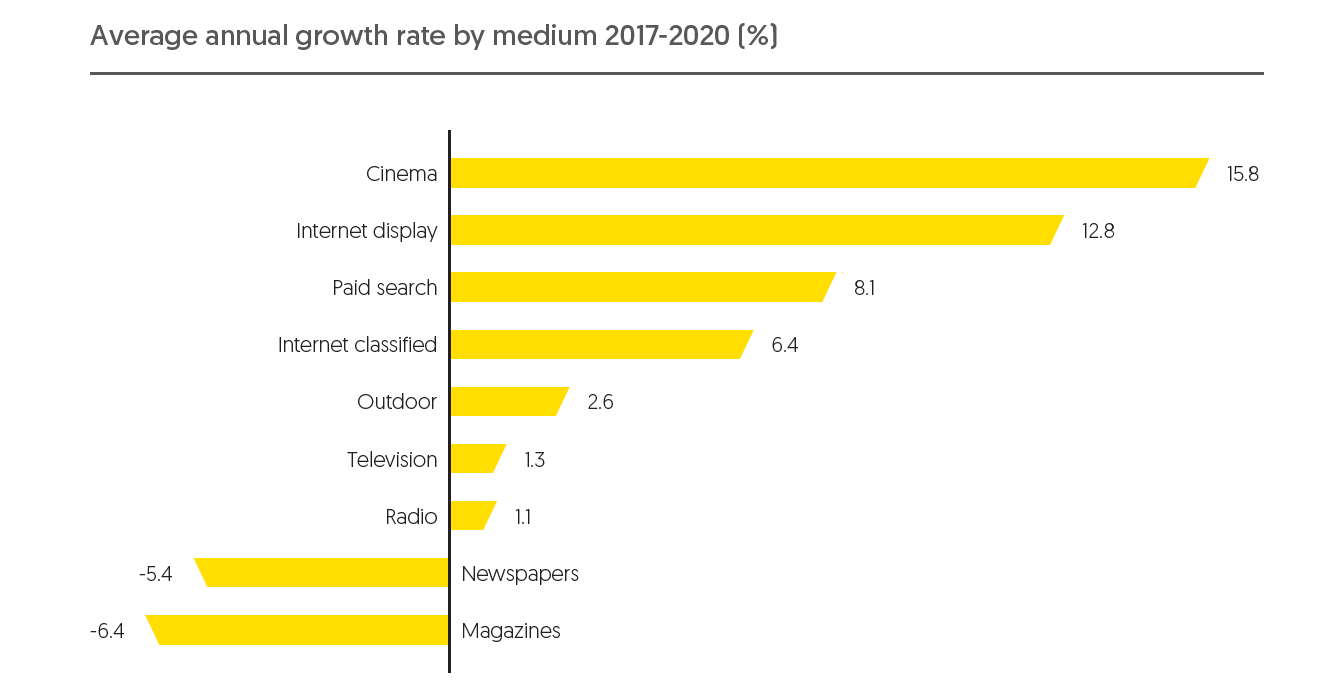

Paid search has undergone constant development in recent years. Search platforms, agencies and brands are applying ever more sophisticated artificial intelligence techniques to improve targeting, messaging and conversion. Search is becoming more integrated with commerce, both online – as brands shift budgets to e-commerce platforms – and offline, as retailers use location and store inventory data to match active shoppers directly with the products they’re searching for. All these developments are attracting higher performance budgets from brands, often new expenditure rather than being diverted from brand awareness activity. Overall, we expect them to drive an average of 8% annual growth in paid search adspend between 2017 and 2020.

The next step in the evolution of search is voice search, but so far there has been little direct advertising through voice assistants. When users make a voice search on a smart speaker, they will normally only be presented with the first organic result; voice searches on smartphones may present more results, but not as many as manual searches. The rise of voice search therefore makes it more important for brands to identify the keywords they absolutely need to own, and to build content that sends them to the top of organic results.

We expect the search platforms will eventually make paid search work with voice assistants, but for now brands need to concentrate on voice SEO, limiting the growth potential of paid search in the short term.

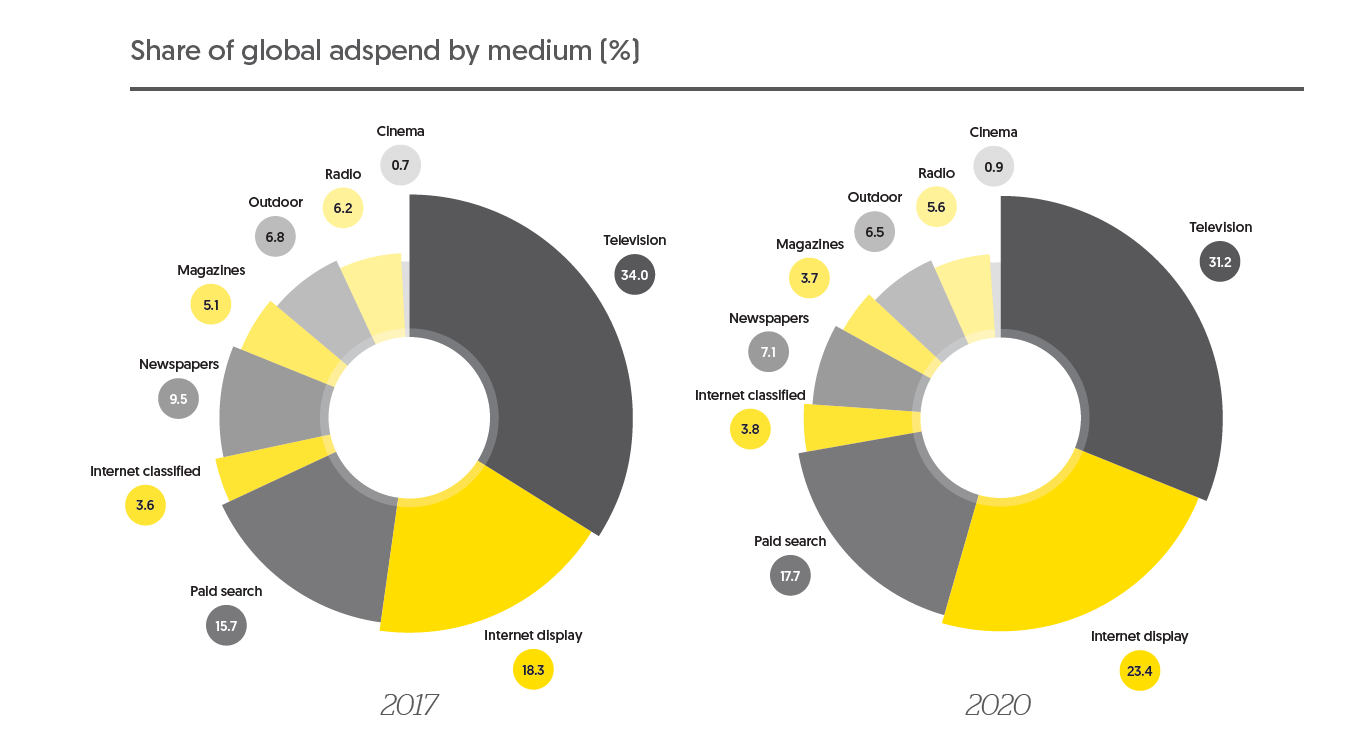

Much of the recent rapid growth in social media advertising has come as platforms have replaced static ads with more engaging video ads. So far these social video ads have acted more as complements to television ads than competitors, but the platforms are now competing with television more directly by hosting long-form content like sport, drama and comedy, and inserting mid-roll ads like those seen in television breaks. Overall we expect social media adspend to grow by an average of 16% a year to 2020, twice the rate of paid search. We count social media as a sub-category of internet display advertising, which will increase its share of global adspend from 18.3% in 2017 to 23.4% in 2020.

The fastest-growing traditional medium is cinema, which we forecast to grow by 16% a year thanks to rapidly rising admissions in China. It is a tiny medium, though, representing just 0.8% of total adspend this year. Otherwise outdoor is the strongest performer, with 3% annual growth. Outdoor is benefiting from its wide reach and ability to create mass awareness, which allows it to complement highly targeted online advertising for premium brands. While targeted online ads move buyers along the path to purchase, premium brands still need to create widespread awareness among non-buyers – a premium brand will only remain one if everyone recognises its premium value.

This excerpt is part of Global Intelligence Issue 7. View the full publication here.

SIGN UP FOR ZENITH INSIGHTS