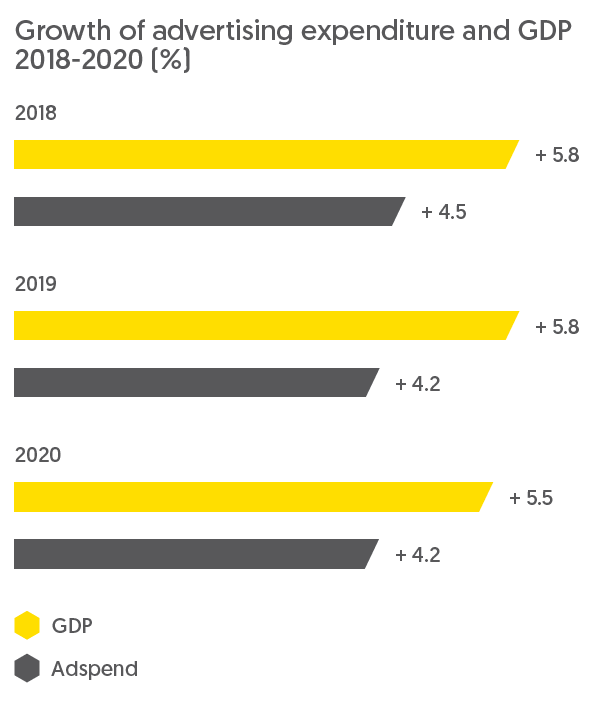

We forecast global advertising expenditure to grow steadily out to 2020, maintaining the 4%-5% pace it has held at since 2011.

In our latest Advertising Expenditure Forecasts report, published in September, we forecast 4.5% growth in global adspend this year, which is the same as the growth rate we forecast in June. Some markets have strengthened since we published our previous forecast (notably Canada and the UK), but these have been counterbalanced by markets that have weakened, particularly the Middle East and North Africa (MENA). Our forecast for 2019 is also unchanged at 4.2% growth, while we have reduced our forecast for 2020 from 4.3% growth to 4.2%. Growth will therefore remain within the 4%-5% range it has maintained since 2011.

Economic growth has picked up this year in Canada and the UK, and demand from advertisers has been stronger than expected, so we have revised our forecast for adspend growth in Canada this year from 3.8% to 5.6%, and in the UK from 0.7% to 2.4%. These two revisions alone will add US$581m to the global ad market this year. We have also made substantial upward revisions in Vietnam (US$131m), France (US$121m), and Taiwan (US$104m). Western Europe is the most improved region, revised up from 2.3% growth in 2018 to 2.6% growth.

After conducting new research into true levels of expenditure in MENA, we have thoroughly revised our estimates of historic ad expenditure in the region. We have also added figures for Iraq, Jordan and Syria, as well as channels targeting Asian-language speakers across the region. The net effect of these changes is that our estimate of regional adspend is now higher than it was previously, but so too is our estimate of the shock the region has suffered from the drop in oil prices since 2014, political turmoil and conflict. We now consider that adspend shrank by 40% between 2014 and 2017, more than our previous estimate of 33%. But we estimate that ad expenditure across MENA totalled US$3.6bn in 2017, ahead of our previous figure of US$2.4bn. We now forecast an average annual decline of 5.5% to 2020, well below our previous forecast of 1.4% average annual decline.

The US will be the leading contributor of new ad dollars to the global market over the next three years, making up in scale what it lacks in speed. China will come second, combining large scale and rapid growth, though its growth is slowing as its scale increases. Between 2017 and 2020 we forecast global advertising expenditure to increase by US$75 billion in total. The US will contribute 26% of this extra ad expenditure and China will contribute 22%, followed by India (5%) and Indonesia (4%).

This excerpt is part of Global Intelligence Issue 7. View the full publication here.

SIGN UP FOR ZENITH INSIGHTS