In this excerpt from Global Intelligence issue 3, we take a look at how the US ad market has developed since the elections last year

Elections always have a big effect on the US ad market, since so much campaigning is done through paid advertising. This is true during the presidential elections years that occur every four years, and in the mid-term elections that occur in between. During last year’s elections nearly US$3bn was spent on political advertising on local TV alone. The results of the elections, however, have less obvious and immediate effects.

The victory of President Donald Trump, though it took much of the world by surprise, has made little difference to the spending plans of most US advertisers. There has been a lot of speculation about deregulation and infrastructure spending to boost the economy, and worries about rising barriers to trade, but so far the Trump presidency has had little effect on the spending power of the average household. And while consumers continue to spend at a steady pace, so will most advertisers.

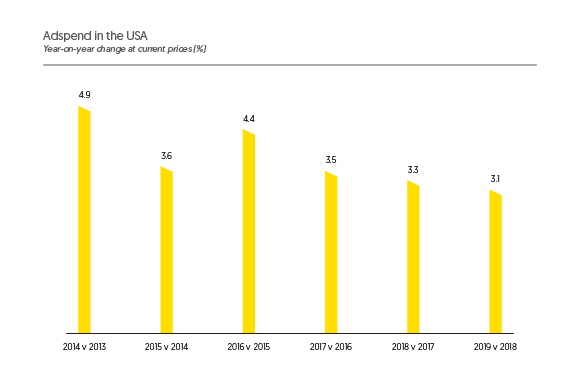

Political uncertainty does seem to have had a slight dampening effect, though. We are forecasting 3.5% growth in US adspend this year, down from the 3.8% growth we forecast before the election. This is a step down from the 4.4% growth registered last year, but that’s no surprise after the boost to spending provided by the elections and the Rio Olympics last year.

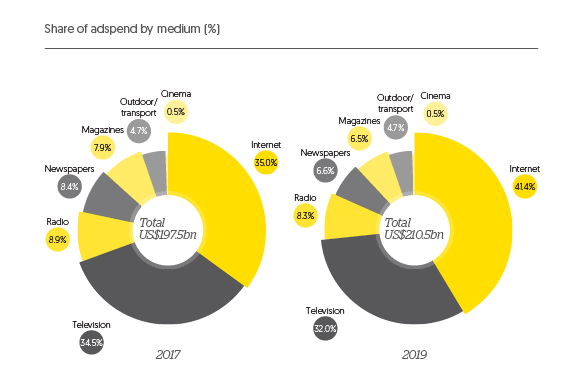

The average American adult spends 34 hours a week watching television, which accounts for 43% of their total media consumption. However, conventional television viewing is declining as consumers spend more time viewing video on other platforms, such as desktop computers, mobile devices and gaming consoles. In Q4 2016, network audiences dropped 5% year on year, while cable audiences fell 4%. This is putting pressure on TV networks to invest in recapturing audiences on these new platforms, and on audience research companies to provide cross-platform measurement.

There is also a lot of working being done to improve audience measurement on local TV, which has historically been rather inconsistent, and – excitingly – to open up the local TV marketplace to true programmatic buying.

Programmatic buying has also come to the out-of-home market: Clear Channel Outdoor currently offers 25% of its digital inventory in 25 markets for programmatic trading, and this is only the beginning. Outdoor contractors are also starting to use facial recognition, internet-connected screens and external data-feeds to reach consumers and track their reactions in new ways.

The print circulations of newspapers and magazines continue to decline, and while the reach of their digital editions is booming, digital revenues have generally not been enough to offset print losses. Nevertheless, publishers continue to invest in new sources of revenue, such as programmatic sales, digital video, native advertising and high-impact print executions.

The full third edition of Global Intelligence magazine is available here.

SIGN UP FOR ZENITH INSIGHTS