As brands continue to shift budgets to mobile advertising, they must reassess their approach to customer acquisition to ensure they continue to reach potential customers effectively.

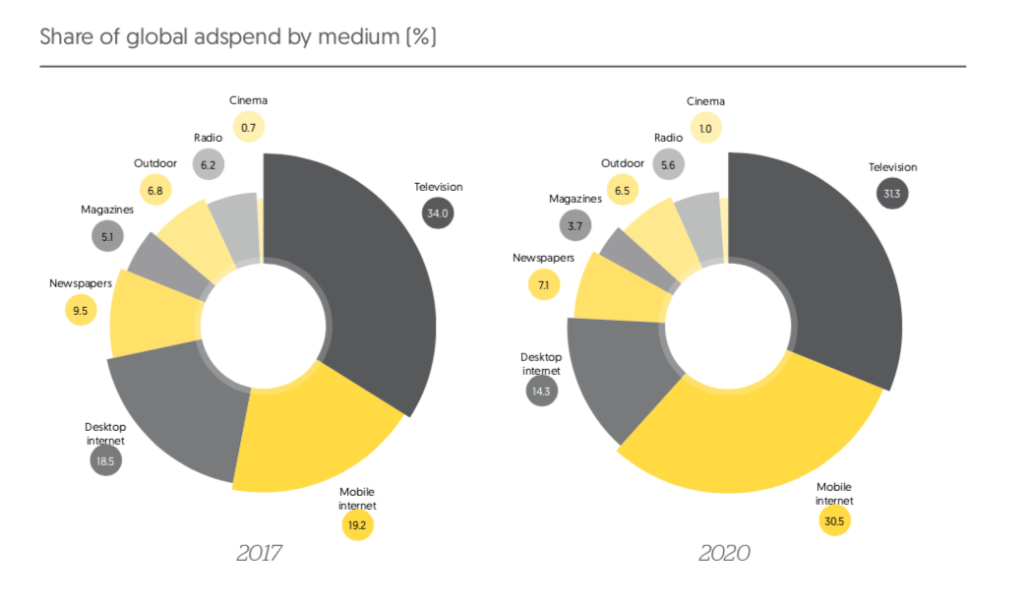

We predict that mobile advertising will account for 30.5% of global advertising expenditure in 2020, up from 19.2% in 2017. Expenditure on mobile advertising will total US$187bn in 2020, more than twice the US$88bn spent on desktop advertising, and just US$5bn behind the US$192bn spent on television advertising. At the current rate of growth, mobile advertising will comfortably overtake television in 2021.

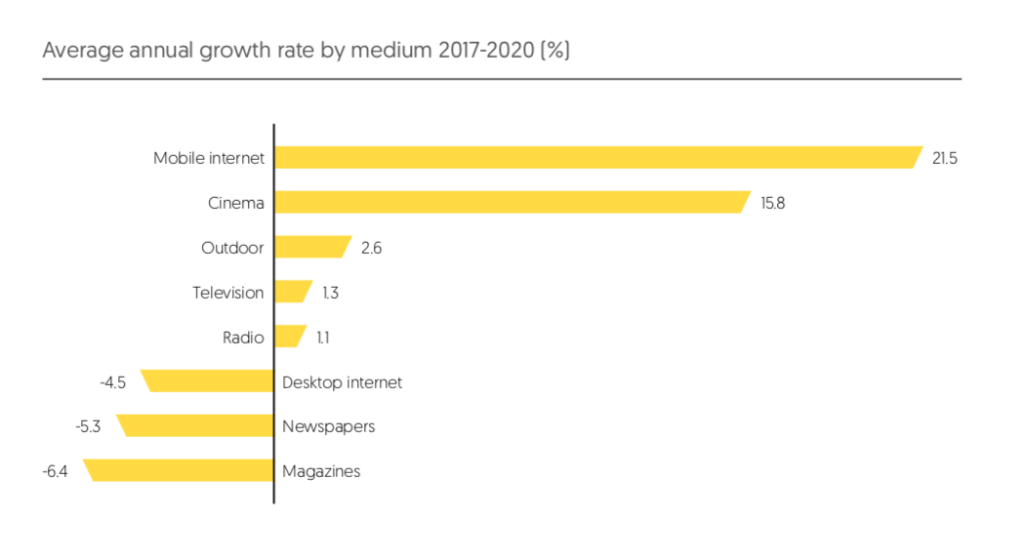

As internet users switch from desktop to mobile devices – and new users go straight to mobile – online advertising is making the same switch. Advertising on mobile devices is rising at a meteoric rate, and is taking market share from most other media. Mobile adspend grew 35% in 2017, and we expect it to grow at an average rate of 21% a year to 2020.

However, brands that are shifting budgets to mobile advertising may be affecting their ability to win new customers and expand their market share. Zenith’s Touchpoints ROI Tracker research* shows that traditional mass media are more effective at driving recall among new or light buyers, therefore having a strong understanding of acquisition channels and retention channels is key.

According to Touchpoints ROI Tracker, television ads are most effective at driving recall among potential customers, while mobile ads are least effective. Potential customers are 53% as likely to recall television ads as existing customers, but for mobile ads this falls to 41%. Targeting mobile ads at existing customers can certainly help brands achieve short-term performance targets, especially because mobile is increasingly tying together the whole consumer journey.

However, mobile is currently less effective at creating long-term awareness among potential customers than traditional media, so brands with a heavy mobile presence should consider investing more in traditional mass media to compensate for this.

Most of the traditional media are still growing despite the inexorable rise of mobile advertising, but generally at very low rates. We forecast television and radio to grow by 1% a year between 2017 and 2020, while out-of-home advertising grows by 3% a year. Cinema, however, is growing at 16% a year, thanks to investment in new screens, successful movie franchises, and better international marketing. The main driver, though, is surging demand in China, where ticket sales increased 22% in 2017. China overtook the US to become the world’s biggest cinema advertising market in 2017, worth US$1.2bn, and by 2020 we expect it to reach US$2.8bn.

Print advertising continues to shrink together with circulations: between 2017 and 2020 we forecast newspaper adspend to shrink by an average of 5% a year, while magazine adspend shrinks by 6%. This refers only to advertising within print titles, though – publishers’ online revenues are counted within the desktop and mobile internet totals, so their overall performance is not as bad as the print figures suggest. Research organisations in some markets provide combined print and digital ad revenue figures for publishers, generally showing that the digital revenues soften but do not reverse the decline in print.

*Touchpoints ROI Tracker is Publicis Media’s brand contact measurement and planning tool, based on more than 1,000,000 consumer interviews since 2004. All rights to the MCA® measurement system including CCF™, BEP™ and BES™ are owned by Integration (Marketing and Communications) Limited and licensed to Publicis Media Limited and its affiliates.

SIGN UP FOR ZENITH INSIGHTS