Marketing imperatives

- Brands using Facebook need to invest in promoted posts to ensure their posts are seen, and have the best chance of engaging their fans

- Instagram is a great way for auto brands to reach aspirational young consumers, but investment here is for the long term, and may not pay off for years

Facebook is still the biggest social platform for most auto brands, at least in terms of the number of fans. Over time, though, it has become harder to use Facebook to engage fans with brand messages. Increased competition for users’ attention, and changes to the news feed algorithm, mean that brand posts may not even be seen by most fans, and those who do see them are likely to scroll past them without reacting to them.

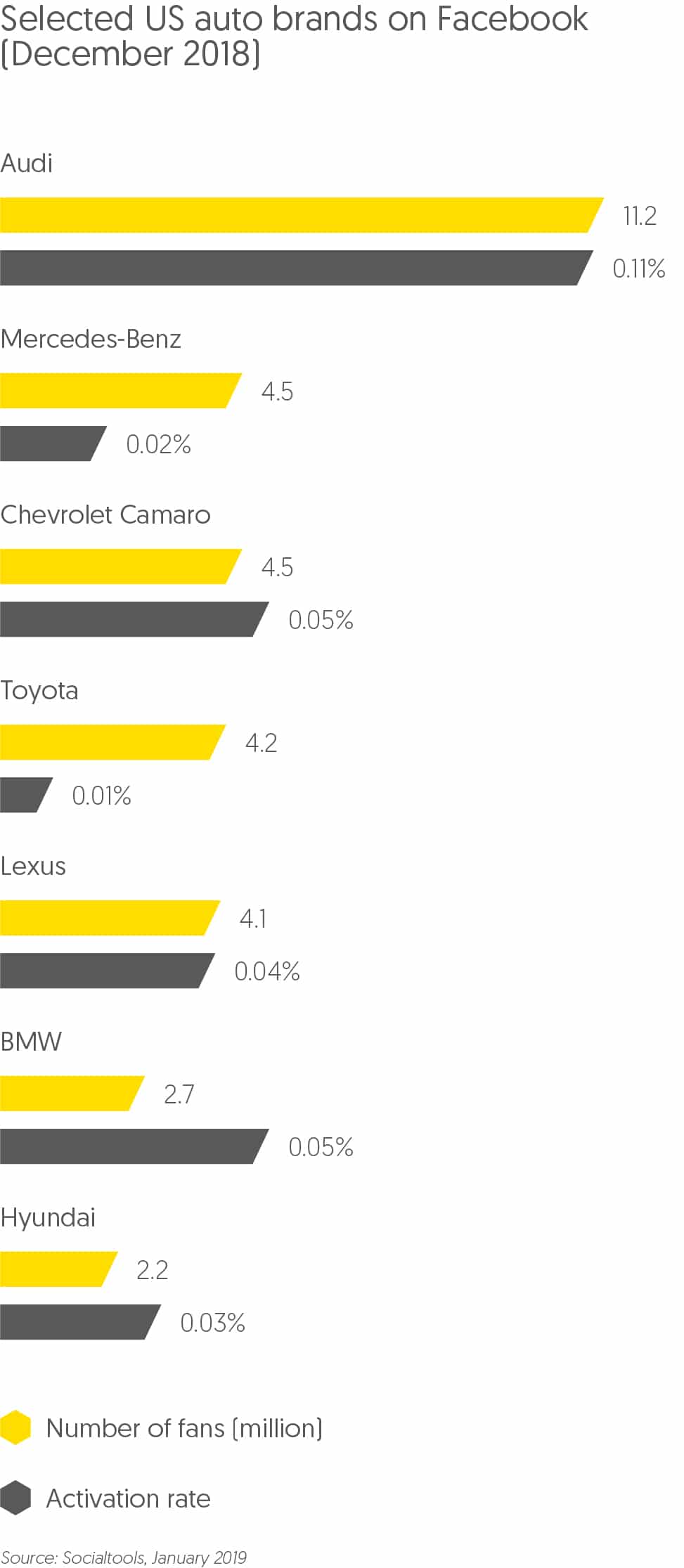

The chart below shows some of the top auto brands on Facebook in the US and demonstrates the wide variation in ‘activation rate’ between these brands. The activation rate refers to the proportion of fans who react in some way to post on the brand page, whether by commenting on it, sharing it, or by clicking on ‘like’ or some other reaction. The first thing to notice is that activation rates are extremely low. Even Audi, the best-performing brand, manages to provoke a reaction from just 0.1% of fans per post. The second is that activation rates vary widely – even among this small sample, by an order of magnitude.

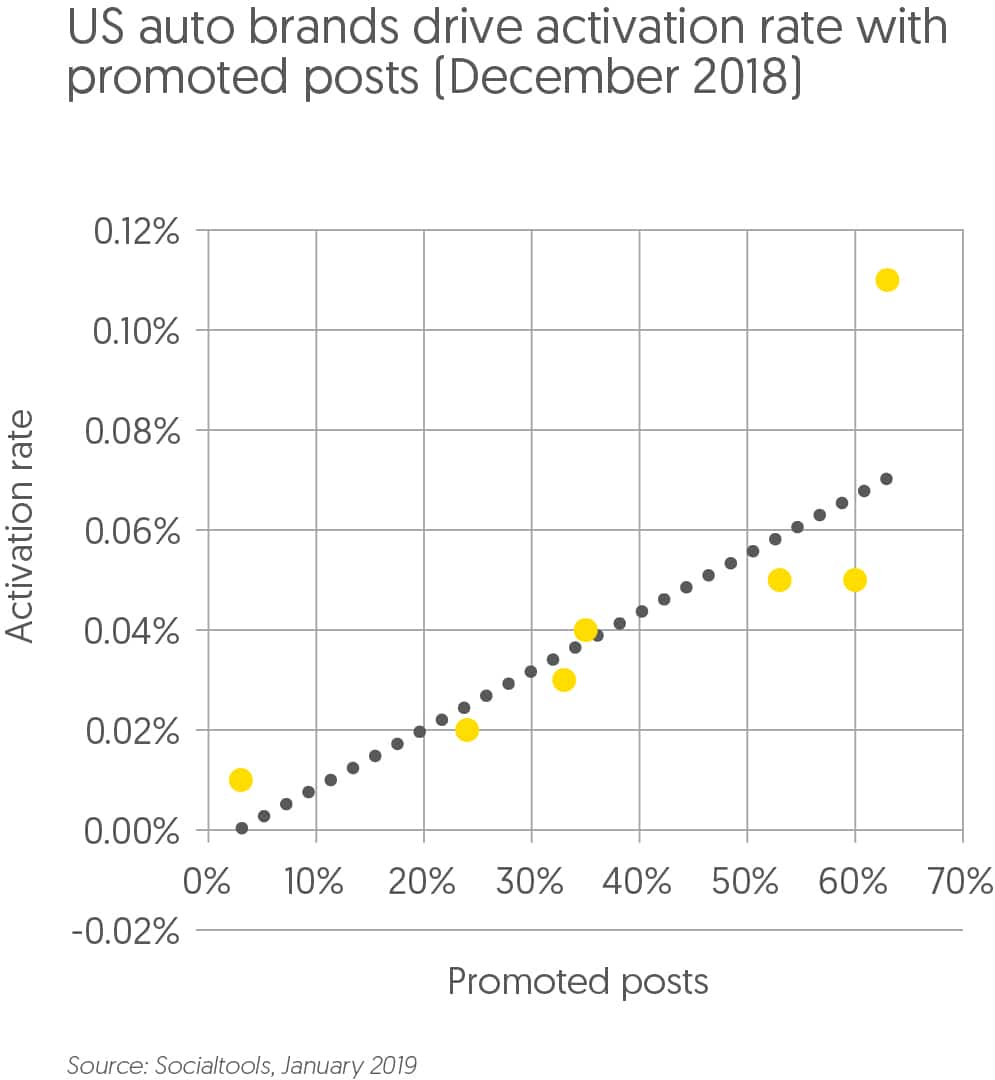

One of the biggest barriers to provoking a fan reaction is reaching that fan in the first place. Now that organic reach has become an uncertain route to exposure, paying for reach by using promoted posts can substantially boost the signal. Socialtools uses machine learning to identify which posts are likely to have been promoted, and which are likely to be organic. We find there is a clear connection between use of promoted posts and activation rate. Among these seven top brands, Audi had both the highest activation rate and the highest share of promoted posts (63% of all posts), while Toyota had the opposite – the lowest activation rate and least promoted posts (just 3%). Auto brands that actively invest in their reach on Facebook are the ones that cut through the noise most effectively.

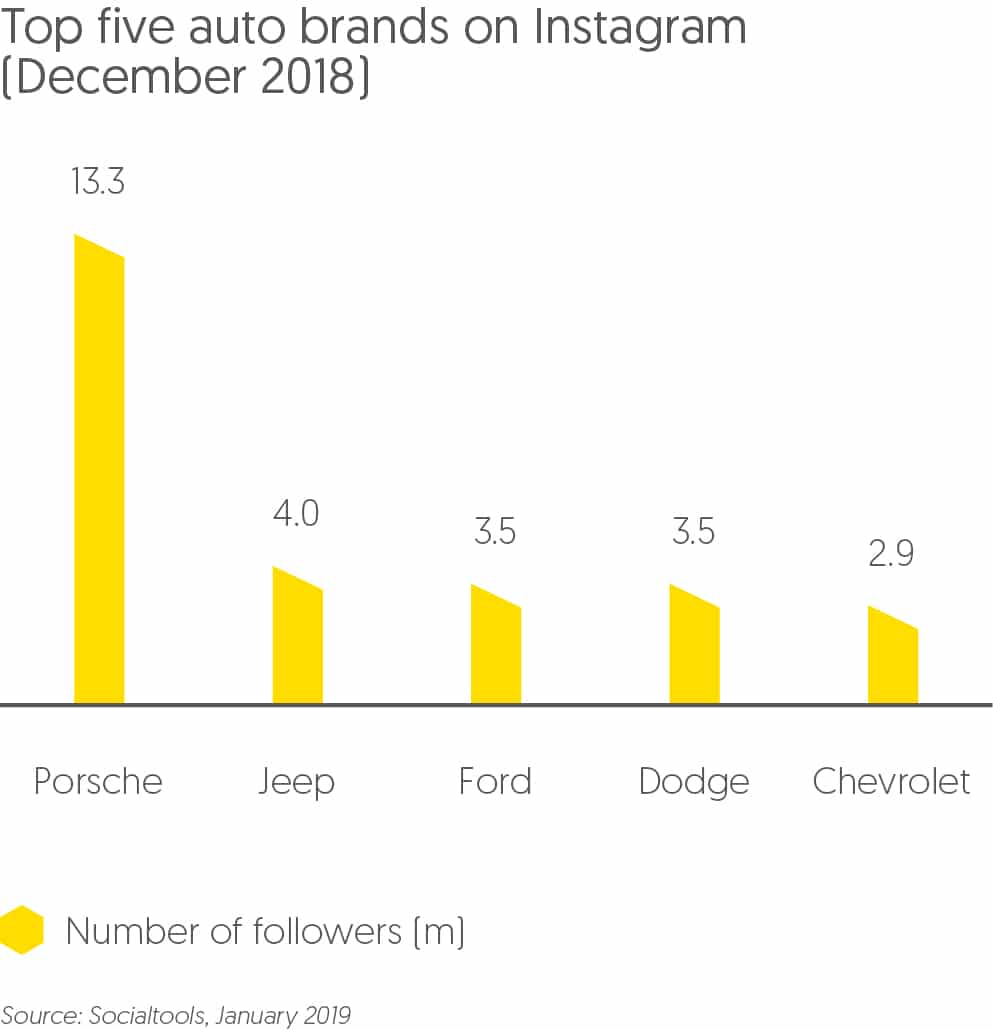

Brands typically use Instagram to reach young people, laying the ground for a purchase that may lie years in the future. Instagram is a much more aspirational platform than Facebook and YouTube, and many users are more likely to follow their dream car brand than the one they’re likely to buy next – which is why Porsche has about as many followers on Instagram as the next four brands put together.

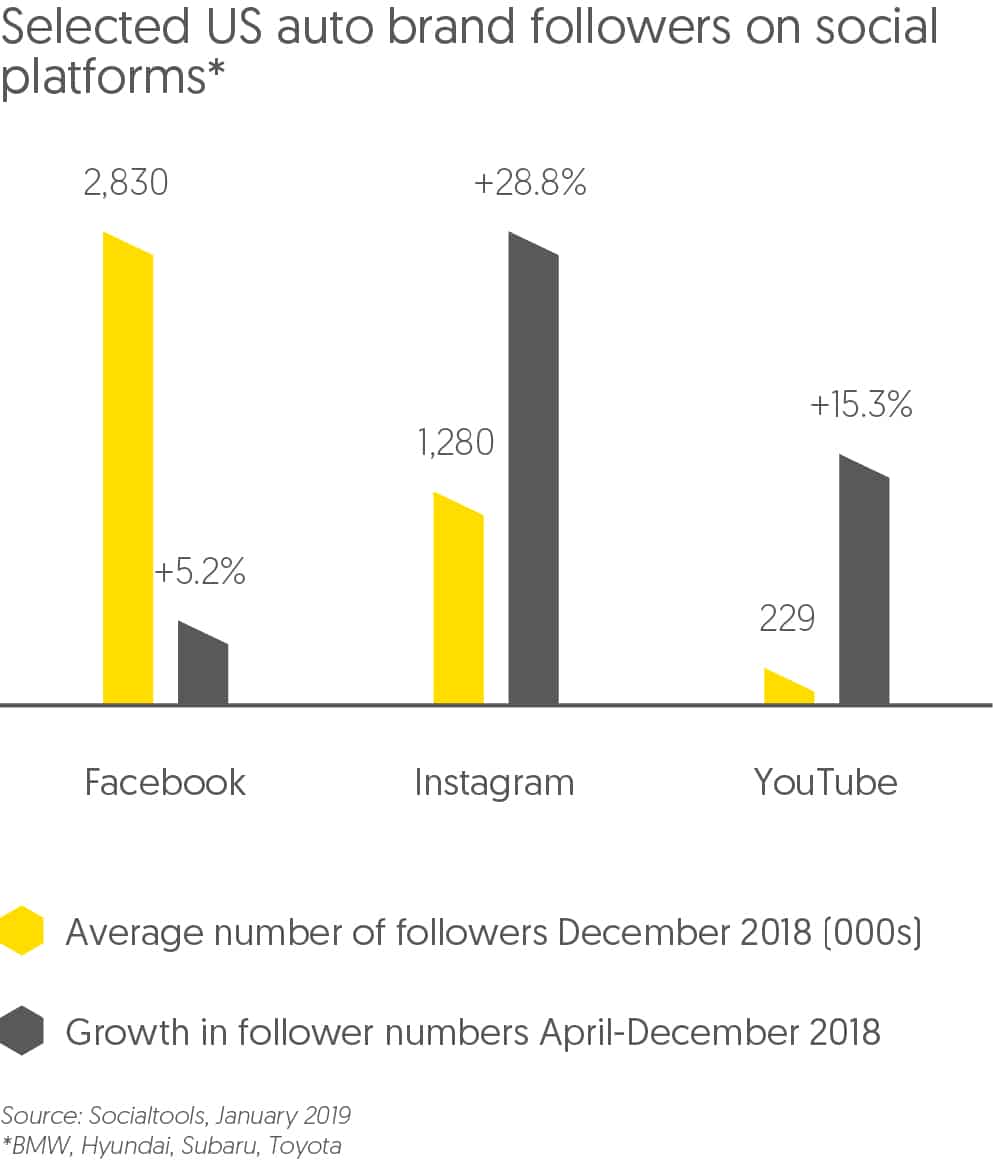

For most auto brands, Facebook is still their biggest source of social followers, but other platforms are growing much more quickly. Between April and December 2018, four representative brands increased the number of their YouTube subscribers three times faster than their Facebook fans, while their Instagram followers grew nearly five times faster. They still had less than half as many Instagram followers than Facebook fans in December, but the gap is narrowing quickly.

Socialtools is Zenith’s proprietary social content performance tracking tool. Socialtools is currently tracking the daily performance of 185,000 pages across six social platforms (Facebook, Twitter, YouTube, Instagram, LinkedIn and VKontakte), providing evaluation of the effectiveness of social content for brands and their competitors in 195 countries. Socialtools charts show performance trends across a wide variety of social engagement metrics. The brand performance data, norms and rankings provide insights into social media best practices for brands in 21 macro categories and 135 categories.

SIGN UP FOR ZENITH INSIGHTS