We published our latest forecasts of global ad expenditure ten days ago. The press release is here. As has been common over the last few years, we emphasised the rapid growth of internet advertising (growing at an average rate of 13% a year to 2018), and mobile internet advertising in particular, as the main engine of global advertising growth. This will push internet advertising into first place as the largest global advertising medium next year.

Internet advertising encompasses a great variety of marketing communications, however, and it bears looking at in greater detail.

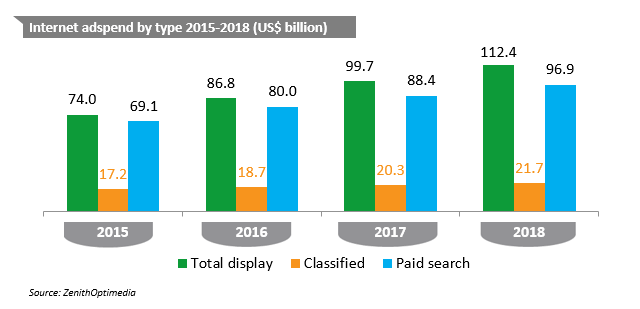

Display is the fastest-growing internet sub-category, with 15% annual growth forecast to 2018. Here we include traditional display (such as banners), online video and social media. All three types of display have benefited from the transition to programmatic buying, which allows agencies to target audiences more efficiently and more effectively, with personalised creative. For traditional display this transition is slowing down, at least in the biggest markets, and we forecast average annual growth of 6% a year between 2015 and 2018. Online video and social media continue to grow much faster – we forecast annual growth of 21% and 23% respectively over the same period. The amount of time consumers spend watching online video is growing by 17% a year, and content producers are working hard to address the scarcity of premium content. Meanwhile, social media is benefiting from its rapid transition to mobile and the introduction of new, engaging ad formats, such as Facebook’s full-screen Canvas ads.

We expect paid search to grow at an average rate of 12% a year to 2018, driven by continued innovation from the search engines, such as personalising search results, automatically matching search terms to content available on advertiser websites, and enhancing local and real-time search. The latter including integrating advertiser data into search results to improve the customer experience – telling consumers how long it will take to walk to the advertiser’s stores, for example, and how long they can expect to wait to be served.

Online classified has been subdued since the downturn in 2009; after the initial shift from print to digital, classified publishers have had to compete with new paid-for and free alternatives for matching buyers and sellers. We forecast average annual growth of 8% for the rest of our forecast period.

Looking at internet adspend by device reveals the dramatic ascent of mobile advertising (by which we mean all internet ads delivered to smartphones and tablets, whether display, classified or search, and including in-app ads). We estimate that mobile advertising grew 72% in 2015, and we forecast an average annual growth rate of 32% a year between 2015 and 2018, driven by the rapid spread of devices and improvements in user experiences. By contrast we forecast desktop internet advertising to grow at an average of just 2% a year.

We estimate global expenditure on mobile advertising at US$50 billion in 2015, representing 31.3% of internet expenditure and 9.2% of total advertising expenditure (this total excludes a few markets where we don’t have a breakdown by medium). By 2018 we forecast mobile advertising to grow to US$115 billion, fractionally behind desktop’s US$116 billion total. Mobile will account for 49.6% of internet expenditure and 18.7% of all expenditure.

SIGN UP FOR ZENITH INSIGHTS