Last week we our third quarterly Advertising Expenditure Forecasts report of 2018. We now forecast 4.5% growth for the global ad market this year, and 4.2% growth in 2019 and 2020.

It will come as little surprise to learn that most of this growth is coming from internet advertising.

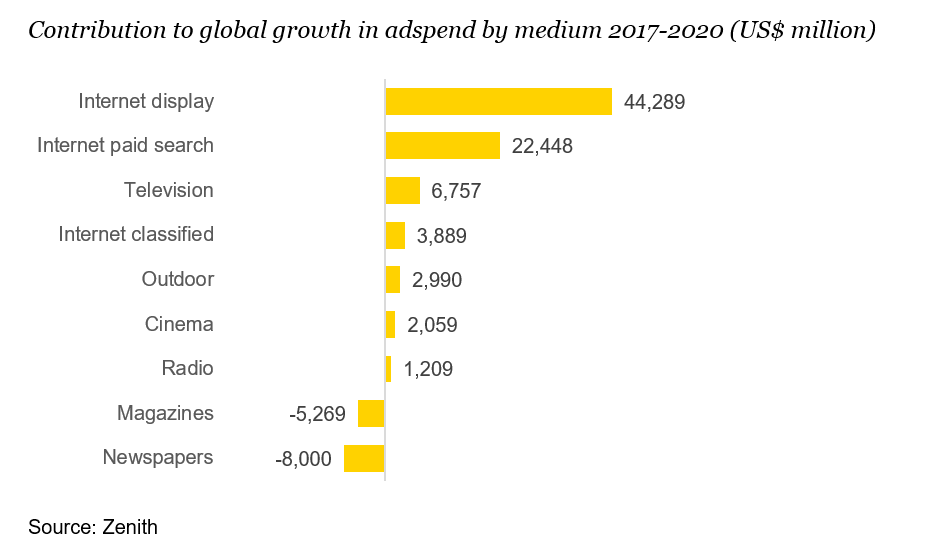

Internet display is by some distance the main driver of global adspend growth, driven by the (overlapping) expansion of social media and online video. We forecast internet display and search to contribute US$67 billion in extra adspend between 2017 and 2020 (again excluding markets where we don’t have a breakdown by medium). This growth will be mitigated by a US$13 billion decline from print. Television will be the second-largest contributor, adding US$7 billion to the global ad market, with smaller contributions from internet classified, outdoor, cinema and radio.

The rise of mobile technology has transformed the way consumers use the internet, and the way brands communicate with consumers. In 2017, more money was spent on mobile ads (US$104bn) than desktop ads (US$101bn) for the first time. However, as technology has developed, the distinction between mobile and desktop has blurred. Instead of a sharp divide between small smartphones, larger tablets, even larger laptops and desktops, devices have a wide range of differently sized screens, some with integral keyboards and others with detachable keyboards. Many large-screen smart-TVs run on mobile operating systems. For many brands, the number of people who view their ads on mobile devices rather than desktop PCs is largely irrelevant to their planning – it is an outcome of whatever their target audiences happened to be using when they came across the ads. While for now we will continue to track mobile and desktop advertising separately, the distinction is becoming less relevant and meaningful all the time.

SIGN UP FOR ZENITH INSIGHTS